Blog

Tax, development and the SDGs

How we are supporting the data revolution

At the core of efforts to meet the Sustainable Development Goals lies a commitment to enhance domestic revenue mobilization. Strengthening capacity to collect tax and other revenue is key for developing countries as they move forward. Not only is this priority enshrined in SDG 17.1, it also sits atop the Addis Ababa Action Agenda.

Strengthen domestic resource mobilization, including through international support to developing countries, to improve domestic capacity for tax and other revenue collection - SDG target 17.1

Strengthen domestic resource mobilization, including through international support to developing countries, to improve domestic capacity for tax and other revenue collection - SDG target 17.1

As a result, there is renewed interest in tax and development from a number of corners. Researchers, for example, are considering how tax policy can shape the development process. At the same time policy makers are keen to know how tax reform can help them raise sufficient revenue to spur economic growth and help them meet their development needs.

UNU-WIDER’s ongoing work on taxation is the subject of a special session at the IEA Congress in Mexico City this month. Here’s a summary of key points.

Providing comprehensive data on government revenue

In late 2015, UNU-WIDER partnered with the International Centre for Tax and Development (ICTD) and agreed to host the Government Revenue Dataset (GRD). UNU-WIDER researchers have been working on the latest developments to the dataset, which will be released in the coming weeks.

The GRD is a cross-country dataset which complements data from traditional sources — such as the OECD’s Revenue Statistics, and the IMF’s Government Finance Statistics — with data from IMF Article IV country reports. This has led to considerable gains in coverage, particularly for developing countries.

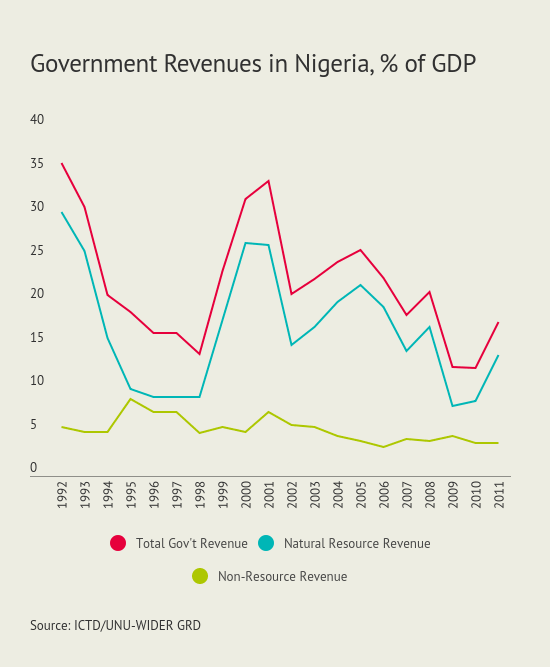

The GRD provides data on government tax, non-tax, social contributions and grants in both local currency and as a percentage of GDP. It also highlights the portion of government revenues that accrue from natural resource extraction. This is of crucial importance for any research or analysis that seeks to explain revenue patterns in resource-dependent nations.

Take, as an example, Nigeria. As the graph (inset) shows, government revenues in Nigeria are extremely volatile. However, the GRD highlights the fact that almost all this volatility is due to oil revenues; indeed, non-oil revenue in Nigeria has been relatively stable over the period in question. The graph also points to one of the side-effects of the so-called ‘resource curse’; governments can find it difficult to plan their spending when they depend on such volatile revenues.

Take, as an example, Nigeria. As the graph (inset) shows, government revenues in Nigeria are extremely volatile. However, the GRD highlights the fact that almost all this volatility is due to oil revenues; indeed, non-oil revenue in Nigeria has been relatively stable over the period in question. The graph also points to one of the side-effects of the so-called ‘resource curse’; governments can find it difficult to plan their spending when they depend on such volatile revenues.

By providing researchers with more complete, detailed and accurate data than exists elsewhere, the GRD has helped researchers to challenge existing research findings — where the source data is often not publicly available — and shed light on questions that previously couldn’t be considered due to data constraints, such as: ‘what is the global distribution of revenue losses from tax avoidance?’; ‘how does conflict affect tax revenue mobilization?’; and ‘to what extent is government revenue affected by external shocks?’

In my presentation at the AIE Congress, I present some findings that extended existing results on the relationship between tax structure and economic growth rates to cover a much larger sample of low- and middle-income countries. I find that revenue-neutral increases in taxes on goods and services such as VAT, offset by reductions on trade tariffs — one of the common policy reforms in developing countries — do not appear to negatively distort long-run growth rates. Indeed, for a subset of lower-middle-income countries the effect was modestly positive.

Tax and benefit microsimulation models

UNU-WIDER researchers have also been involved with a range of country-specific microsimulation models. Based on the EUROMOD platform, SOUTHMOD allows users to examine the effects of changes in tax or benefit policies on poverty, inequality, revenue and expenditure. Many developing countries today are faced with the twin challenges of not only raising more domestic revenue to finance development, but also implementing potentially costly social reforms such as old-age pensions or other benefits. Microsimulation models provide a valuable tool for researchers and policy makers to estimate the potential welfare effects of any changes in tax-benefit policy.

The SOUTHMOD project is bringing tax and benefit microsimulation models to a number of developing countries for the first time. Researchers are also using the models to assess policy impact in these contexts. For example, research presented by Robert Osei at the IEA Congress uses the GHAMOD model to consider the effects of expanding social protection on the income distribution and efficiency, as measured by the impacts on the number employed in the formal sector.

Opening up existing data sources

Last, but by no means least, is UNU-WIDER’s work on administrative tax data in South Africa. As part of the Regional Growth and Development in Southern Africa project, the South African government has opened up firm-level data to researchers for the first time.

This important step allows researchers to reflect on past tax reforms and assess their impact in terms of value-for-money and efficiency. At the end of the day it is firms that are the key drivers of economic growth in an economy — an understanding of their behavioural reactions to government policy is therefore vital.

Jukka Pirttilä presents research at the IAE Congress that examines the responsiveness of firms to corporate income tax schedules. The study finds that firms tend to ‘bunch up’ at threshold levels of corporate income tax rates, suggesting that South African firms react quickly to changes in the rate of tax levied but that much of this response is due to changes in reporting behaviour and not economic activity. The implications for tax policy are, thus, that the current graduated tax schedule does not necessarily encourage greater economic activity and job creation. However, tax rates for small businesses might well encourage formalization of their activities.

End goal: taxation to raise revenues

The end goal of research on taxation and development is to assist developing countries to raise as much revenue as possible, whilst also helping to stimulate growth and reduce poverty. You can learn more about UNU-WIDER’s work on taxation and development via the GRD, and the SOUTHMOD and Regional Growth and Development in Southern Africa projects.

The views expressed in this piece are those of the author(s), and do not necessarily reflect the views of the Institute or the United Nations University, nor the programme/project donors.

Join the network

Join the network