Blog

Obstacles for Mozambique’s manufacturing firms amplified by macroeconomic disturbances

Mozambique has been facing macroeconomic difficulties since 2015. This has amplified the obstacles for micro, small and medium-sized manufacturing firms, but the actual problems lie deeper.

The 2017 Survey of Mozambican Manufacturing Firms (IIM 2017) shows that Mozambique’s structural transformation is still in its very initial phase, and that the manufacturing sector is struggling. This is backed by aggregate data from the World Development Indicators showing that the sector has been in decline over the last ten years despite large migrations out of the rural areas and into the cities.

Of the 840 companies interviewed in 2012, 308 either closed down (216) or were not to be found (92). The remaining 523 companies cut down on their number of employees by a total of 5,100 jobs between 2009–17. Furthermore, company owners are less likely to report profits and more likely to report large losses than five years ago.

The IIM 2017 report identifies many potential explanations for the apparent downturn, but three main complications stand out:

1. Difficult and non-transparent laws

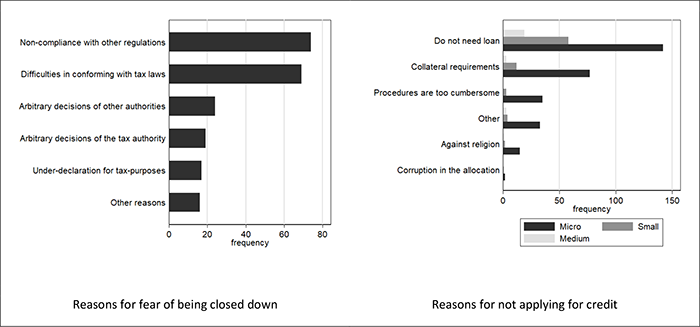

Company owners do not have basic knowledge about tax laws and other regulations related to their companies. Owners of informal companies generally do not know how to register their companies. In around half of the companies in the sample the owners said they fear being shut down by the authorities. Some complain that both taxes and fines are arbitrary, and there seems to be a large variation across provinces and districts.

One example of the difficulty to comply with tax regulations was explained by a shop owner who repairs electrical devices: “Many firms are informal. For us, it was important to create a normal firm for people to accept us as a business. Also, to be able to issue invoices. For us, it is not a question of not paying taxes; we want to comply with our obligations. However, we would like to have more ease when paying taxes. We are being treated like a company that bills much more money than we do.”

Another interviewee summarized why his business does not export: “Sometimes we even have a good price out there. But when we calculate the local expenses, for example when we order and fill a container, these expenses are very high in Mozambique. If we exported, we would earn a bit more. But the difference is so small that we prefer to sell to a national company.”

2. Low access to credit

Around 70% of the interviewed firms show a demand for credit, however 44% of the interviewed firms are not able to obtain this credit, due to either credit application rejection or self-selection. The main reasons cited by the company owners for being credit constrained are that the banks put up too strict conditions in terms of collateral, too much red tape, and too large interest rates.

One business owner expressed the situation as follows: “A company can only obtain a bank loan if it has reported wealth. Or if it has bank accounts which demonstrate this. But if we have a bank account with 2 or 3 million Meticais, they give us a bank loan with very high interest rate, around 32–34%. This is very, very high”.

3. Macroeconomic disturbances

Since 2015, Mozambique has been facing macroeconomic difficulties due to the discovery of hidden debt that has forced the public sector into a spending crisis that has spilled over into the private sector. The macroeconomic conditions have a direct effect on sales through demand. The lack of demand was mentioned by almost all interviewed firms when asked what difficulties they are facing: “Now, there is no business. The clients don’t come.”

It is imperative to improve the business environment

However, more importantly than affecting demand directly, the macroeconomic conditions amplify the existing obstacles described above. First, the government has had to cut back on spending, which has likely led to a deterioration of the quality of services at both central, provincial, and district levels. Second, the financing of the exposed debt has contributed to raising the already high interest rates at the central level, which spills over into interest rates offered by banks.

For these reasons, it is imperative to improve the business environment in order to reduce the effects of economic downturns and facilitate growth during phases of recovery. A place to start is more transparency and better communication regarding the registration process and compliance with tax laws.

The views expressed in this piece are those of the author(s), and do not necessarily reflect the views of the Institute or the United Nations University, nor the programme/project donors.

Join the network

Join the network