About

Domestic Revenue Mobilization programme

The aim of UNU-WIDER’s Domestic Revenue Mobilization (DRM) programme is to help improve developing countries’ tax systems and to strengthen their domestic capacities for revenue collection. Efficient domestic resource mobilization will lead to increased financing of crucial public goods needed for the achievement of the 2030 Agenda for Sustainable Development. The DRM programme is financed by the Norwegian Agency for Development Cooperation (Norad).

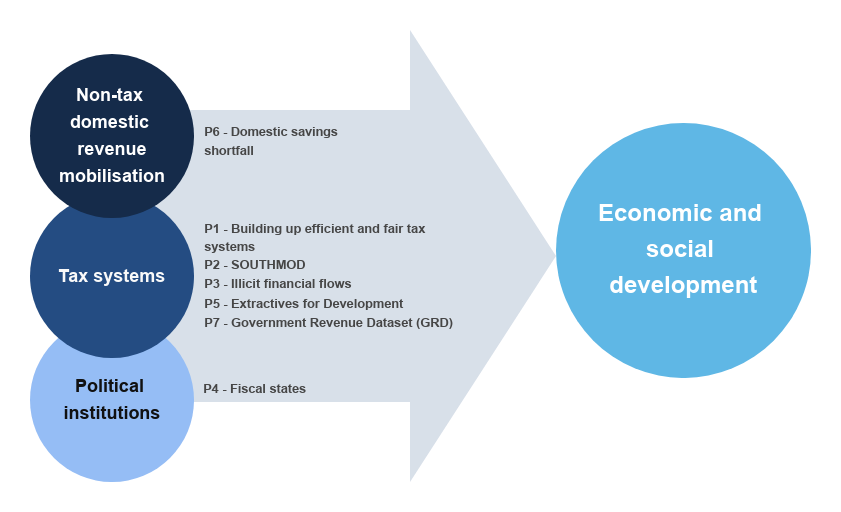

The programme addresses the challenges of domestic revenue mobilization through seven thematic and inter-connected projects around three themes: development of tax systems, non-tax domestic revenue mobilization, and political institutions.

Developing tax systems, addressing questions of illicit financial flows, making sustainable use of extractives

As governments seek to mobilize more resources to finance public expenditures for economic and social development, the ability to design effective tax and benefit systems has become indispensable for the achievement of the Sustainable Development Goals (SDGs).

Two of the projects in the DRM programme — Building up efficient and fair tax systems and SOUTHMOD — provide support to governments in developing countries specifically in the use of administrative tax data and tax-benefit microsimulation models. These tools support efficient and equitable decision-making related to tax systems and public expenditure.

A challenge for Southern governments in raising domestic revenue are the illicit financial flows out of the country. These financial flows could provide much needed resources to fund critical investments in social development. The project on illicit financial flows builds on current advances in research, and expands the research frontier in measuring and monitoring international financial flows and their impact.

Over the last twenty years, extractive industries — mining, as well as oil and gas — have become more important sources of government revenues in many low- and middle-income countries. The project on extractives addresses the challenges faced by countries in mobilizing revenues from natural resources while protecting the environment and minimizing social harm.

Examining political dimensions of tax systems and different sources of domestic financing

Building efficient and equitable tax systems is not just a technical issue, but also reflects the underlying incentives of policy-makers to improve the tax system and make sure taxes are paid. The fiscal states project examines the political determinants of the investments that governments make in building tax systems capable of raising revenues from a multitude of sources.

In addition to increasing public revenue collection, enhancing the domestic resource mobilization means looking into other sources of domestic development financing. The project on domestic financing aims to understand the motives of citizens and firms to save, as well as the role of the public sector in addressing the savings shortfall in developing countries.

Government Revenue Dataset (GRD) is a database that presents a complete picture of government revenue and tax trends over time and allows for analysis at the country, regional or cross-country level. This unique dataset will be an important asset for the research undertaken in the DRM programme.

Connections between projects

Domestic revenue mobilization is important for economic and social development by allowing governments to finance critical public goods necessary for positive health and education outcomes. Project 6 (P6) addresses the non-tax dimension of domestic resource mobilization. The effectiveness of tax systems matters in mobilizing domestic resources, and P1, P2, P3, P5 and P7 are central in addressing the research and policy gaps in improving the functioning of tax (and benefit) systems. Political institutions as studied in P4 contribute to the understanding of the motivations of governments to invest in their tax systems.

Together, the seven projects provide a holistic and comprehensive approach to analysing the economic and political challenges around domestic revenue mobilization.

Join the network

Join the network