Blog

Studying COVID-19 through the lens of microsimulation

The role of tax and benefit policies in alleviating poverty and inequality

As the crisis caused by the COVID-19 pandemic evolves, developing nations are struggling to deliver economic assistance and public services to their citizens, under pressures of fiscal constraints and tax revenue losses. To help governments in the developing world navigate through the crisis, it is important to improve our understanding of the effects of the pandemic and related public measures on poverty and inequality.

The COVID-19 pandemic is on course to reverse years of progress in reducing extreme poverty. To support policy makers in an effective response, research analysing policies aimed at providing economic relief is critical. In this context, UNU-WIDER has launched a major research project on COVID-19, in collaboration with the SOUTHMOD group, SASPRI, and the University of Essex. The research project covers nine countries in the developing world (all SOUTHMOD countries and South Africa).

Our consortium aims to analyse the policy responses and impact of the pandemic using country-specific tax-benefit microsimulation models, developed by UNU-WIDER and collaborators. The primary benefit of these models is that they allow comparison between different policy scenarios.

We are particularly interested in understanding how the livelihoods of specific groups have changed during the pandemic. Which policy measures have governments introduced to mitigate the fallout from the crisis? How were family farmers, self-employed workers, children, or the elderly affected by the crises and the tax-benefit measures adopted in response to the crisis?

A first peek at changes in household incomes in Uganda

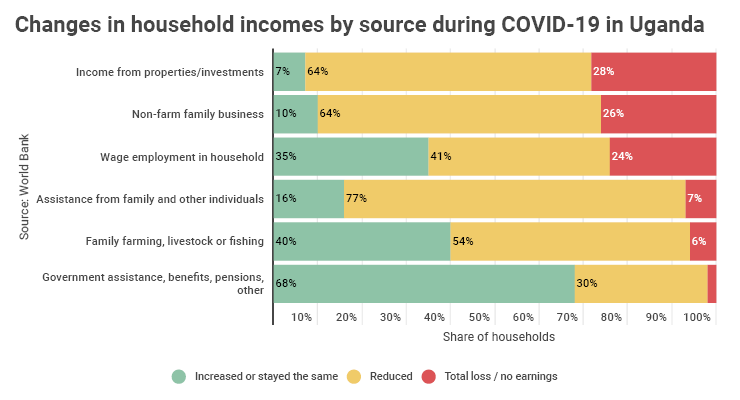

The first challenge in our undertaking is to understand how people’s incomes have been affected by the pandemic. Ideally, representative data with sufficient details collected over the course of 2020 and beyond as shown in the figure below for Uganda provide such information. Derived from new World Bank-supported phone surveys on COVID-19, the data show us that household incomes changed considerably between March and June.

But not all income sources were equally affected. Respondents reported large losses in most income sources, with smaller reductions in earnings from own-account agricultural activities and government benefits.

Capturing and modelling COVID-19-related policy measures

Apart from information on how people’s economic situation evolved during the pandemic, we also need information on COVID-19-related tax and benefit policies. As part of the project, the SOUTHMOD national teams have gathered detailed information about social benefits, tax waivers and tax deferrals linked to COVID-19 that have been implemented by their respective governments.

In countries such as Mozambique and Ghana, utility fees were reduced or waived for consumers for the rest of the year. Ghana also exempted frontline health workers from personal income tax for eight months in 2020. Vietnam in turn offered a wide range of COVID-19-related financial relief packages to its citizens, including benefits for employees that were suspended or laid off in the aftermath of the pandemic.

Using this rich database of relevant policies across countries, we incorporate the tax-benefit measures into the SOUTHMOD models. Together with the data reflecting how COVID-19 has affected incomes at the individual level, we can then ultimately assess the impact of the tax and benefit measures on poverty and inequality.

First results and next steps

First results for Ecuador by Jara, Montesdeoca and Tasseva show a dramatic increase in income-based poverty and inequality in June 2020 compared to December 2019. In addition to documenting these trends, the authors estimate the remedial effects of the Ecuadorian tax-and-benefit system, along with a new emergency cash grant provided to certain low-income families. While the cash grant offers some income protection for the poorest families, tax-benefit policies in Ecuador have overall had a small impact in mitigating income losses during the pandemic.

Over the next few months, we will examine in greater detail how the specific policies affected poverty and inequality in the different countries, and to what extent these measures could offset the negative impacts of the crisis. Apart from a comparative study across seven African countries, we will address these questions also for Vietnam and analyse Ecuador’s path adopting a longer-term perspective.

The views expressed in this piece are those of the authors, and do not necessarily reflect the views of the Institute or the United Nations University, nor the programme/project donors.

Join the network

Join the network