Blog

Unlocking the mystery of domestic savings

What difference do they make?

The socioeconomic fallout from the ongoing COVID-19 pandemic has brought to the fore discussions on domestic resource mobilization (hereafter DRM). Raising domestic taxes has monopolized policy attention, however, given the attendant and ensuing needs in developing countries, raising savings rates is equally important. Domestic savings provide the necessary investible resources needed for long-run and sustained economic growth.

Investments and savings go hand-in-hand

Research has found that investment is a key determinant of economic growth. Investment rates are determined by national and household savings rates. These two facts indicate that the amount of domestic savings is a crucial determinant of economic growth: countries that have high savings rates tend to grow faster on average. Furthermore, a high savings rate in line with a country’s investment rate reduces vulnerability to sudden shifts in international capital flows.

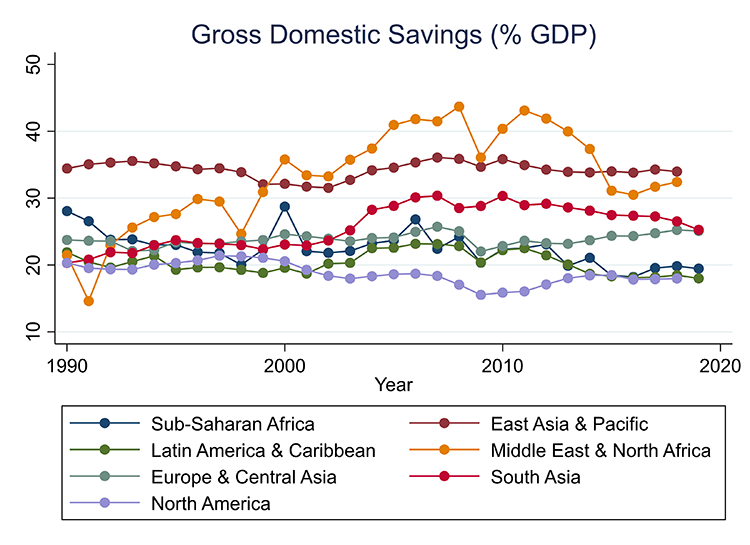

Figure 1: Domestic savings around the world

Over the years, financial liberalization and solid macroeconomic policies have been implemented with varying degrees of success across regions, making savings vary considerably within and across regions. East Asian countries have demonstrated larger savings ratios than their sub-Saharan African (SSA) and Latin America and Caribbean (LAC) counterparts. Savings, in part, contributed to the sustained growth success of East Asia. Over the period 1990–2019, the average savings ratio in East Asia was 34% compared to 20% in LAC and 22% in SSA. These ratios are similar to high-income regions — 19% in North America and 24% in Europe and Central Asia — but it is worth noting that these regions have much higher tax ratios than developing regions.

Worryingly, the savings ratio in SSA has fallen from a high of 27% in 2006 to 19% 2019 (Figure 1). For economic growth to increase in SSA, savings rates and ratios must increase.

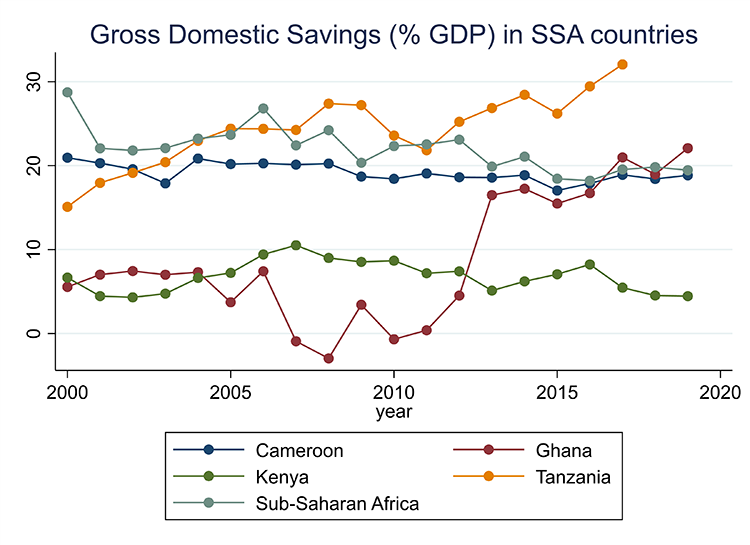

Problems of savings in sub-Saharan Africa

In SSA, domestic savings ratios dwindled significantly during 2000–19 (see Figure 2). Average savings rates on the continent dropped from a peak of 29% in 2000 to 24% in 2005. Rates increased again in 2016 (27%) but dropped steadily till 2019. Within SSA, we can observe considerable variation in savings ratios — the level and growth of savings in Tanzania is high while in Kenya it has been consistently low. The level of savings has been low in Ghana, although the growth rate is more volatile. Cameroon has a high savings rate but low growth in savings.

Figure 2: Domestic savings, SSA countries

Economic growth, financial sector development, and demographic phenomena interact in complex ways which contribute to the dismal savings rates in SSA. Financial liberalization policies have been implemented in most SSA countries, resulting in increased availability of credit which relaxed liquidity constraints. This had the unintended consequence of discouraging savings and instead encouraging consumption.

Until relatively recently, average income growth in SSA had been low and unstable, contributing to the low savings ratios across the region. Savings ratios in most SSA countries picked up around the same time as average income grew. Furthermore, from 2000–15 the region saw a reduction in the percentage of working population (absence of a demographic dividend) which was associated with a corresponding reduction in savings ratios across countries.

Are there common factors explaining savings ratios in different countries?

The cross-country literature has indicated a variety of explanatory variables as determinants of savings ratios. Productivity growth is one important determinant of savings across countries. Another important factor in explaining investment and economic growth rates across countries is the functionality of institutions, and institutional or administrative capacity.

There is a multitude of datasets on institutional quality (Varieties of Democracy; Polity IV; Quality of Government) making it much easier to include such measures in case studies and cross-country analysis of determinants of savings. The importance of institutions is reflected in UNU-WIDER's DRM project Fiscal states: the origins and developmental implications which seeks to decipher the factors which determine taxation and the different development trajectories, given the level of taxation.

The way forward

Our project The domestic savings shortfall in developing countries – what can be done about it? seeks to address the policy question: how can one increase domestic savings in developing countries, where the evidence base for policy is patchy. Together with our Kenyan partners we will be compiling a book on domestic savings in SSA. The book will include six thematic chapters and four country chapters (Cameroon, Ghana, Kenya, Tanzania).

Until now, there has been limited research taking place on this important topic, despite the increasing availability of good quality data. Through this research work we hope to unlock the remaining questions and bring forth policy solutions that will help countries in the Global South increase their domestic savings and eventually financial independence.

The views expressed in this piece are those of the author(s), and do not necessarily reflect the views of the Institute or the United Nations University, nor the programme/project donors.

Join the network

Join the network