Blog

Bootcamp for better tax policies in Africa

‘I intend to see a world in which tax policy research is based on evidence, and policy decisions are data-driven.’ This is an aspiration expressed by a participant of the WIDER Winter School 2022. The comment summarizes well the reasoning behind the course and UNU-WIDER’s goals for domestic revenue mobilization in the Global South.

The first part of the 2022 Winter School was held 31 May – 2 June 2022, consisting of a 3-day online ‘bootcamp’ to equip participants with an understanding of how to use statistical software for data analysis and refresh their knowledge of statistical concepts in economics. Based on the lively discussions and the feedback we received, the participants found the sessions on impact evaluation, randomized controlled trials (RCT), and using the theory of change in research and analysis most useful for their work.

'The session helped me refresh my understanding on experimental and non-experimental approaches to conduct programme impact evaluation analysis. It covers important topics on how to set clear and measurable indicators using the theory of change approach, and how to design appropriate methods of analysis for evidence-based policymaking.'

The virtual bootcamp session was an eye-opener to me.

Taxation in Africa?

Countries in the Global South have increased their tax revenue in recent decades, but overall revenues have often remained too low to sustain the provision of critical public goods. The problem is most evident in Africa. Well-planned, efficient, and equitable taxation would help countries reduce inequalities, combat poverty, and provide social services.

In many African countries, revenue authorities would have an opportunity to analyze the tax data they have already collected for revenue purposes. This data can be used for a broader range of tax policy research topics that support efficient, fair, and evidence-based tax reforms. To make this data accessible, we have embarked on a mission with our partners in sub-Saharan Africa.

The research collaboration that we have in place in several African countries has covered topics of tax compliance, formalization of businesses, and personal and corporate income taxation. The research questions have been formalized by the local researchers and analysts. We recently reached a significant milestone in our collaboration in Uganda where the Ugandan Revenue Authority opened their secure research lab. This new lab has panel data on firm taxation with many more datasets planned to come.

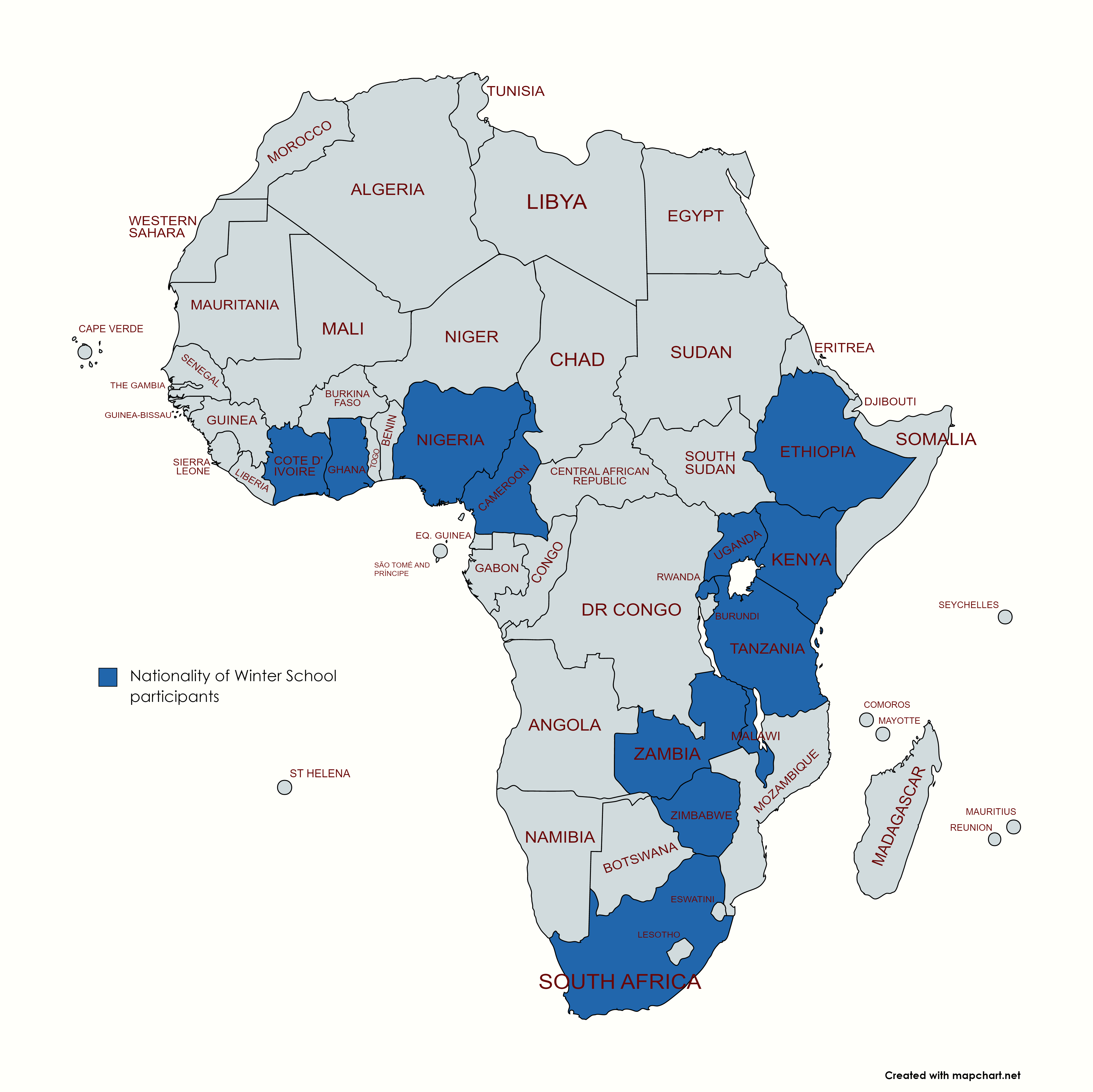

Beyond our existing collaboration, with the Winter School, we aim to offer tools and expertise to analyze tax data in other African countries. The course participants include 28 researchers and analysts from 13 African countries working for revenue authorities, ministries, and research institutes. By bringing together these scholars, we also hope to build a network of professionals equipped with tools needed for consulting each other on their approach to data and research.

As one of our course participants summarized: ‘I wish to see a turnaround, where less developed countries have more domestic resources to meet public expenditure needs and thus become less reliant on foreign aid or external borrowing’.

The next steps

The second part of the Winter School is organized in July in Stellenbosch, South Africa, in collaboration with Stellenbosch University. During the 5-day intensive in-person course, leading experts from UNU-WIDER’s global network will deliver lectures, and participants will work intensively in the lab sessions to strengthen their quantitative research skills.

'Taxpayers’ behaviors range from not complying to those who are willing to comply. Tax systems and policies for a long time have not solved the problem. I wish to see the mutual connection for compliance between taxpayers and governments for smooth operations and socioeconomic development.'

I am excited and look forward to meeting our inspired Winter School class 2022!

Amina Ebrahim is a Research Associate at UNU-WIDER. Her research interests include labour and public economics, focusing on employment, tax, and social policies. Her recent research has focused on the evaluation of the South Africa’s youth wage subsidy policy using tax data from South Africa. Her works focuses on making large administrative tax data available for research and research collaboration with African revenue authorities.

The views expressed in this piece are those of the authors, and do not necessarily reflect the views of the Institute or the United Nations University, nor the programme/project donors.

Join the network

Join the network