Blog

Global tax reforms, net-zero, and domestic revenue

Food for thought from the DRM programme

Domestic revenue mobilization (DRM) and taxation have gained prominence lately on the global agenda, most recently with the resolution for the United Nations (UN) to lead the global discourse on tax rules. As we approach the halfway point to Agenda 2030 and the Sustainable Development Goals (SDGs), and the last year of UNU-WIDER’s DRM programme, it feels appropriate to start a blog series on the topical discussions and events related to domestic revenue mobilization and SDG 17: Partnerships for the goals.

In the first blog of this series I will analyse discussions of the net zero agenda, illicit financial flows (IFFs), and the role sub-Saharan Africa (SSA) plays in the mission of bringing financial independence and inclusive growth to the developing world.

International taxation issues and illicit financial flows

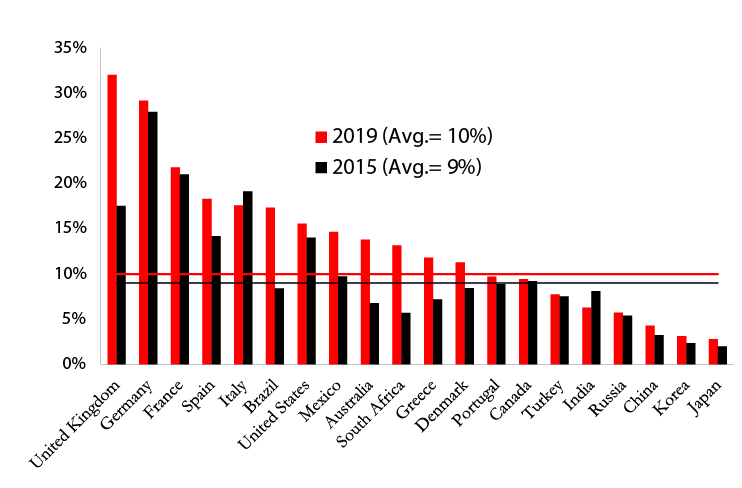

In October 2021 136 countries agreed to global tax reforms under the OECD/G20 Base Erosion and Profit Shifting (BEPS) Inclusive Framework. Of importance for global financial flows is the 15% global minimum corporate tax which should, in principle, reduce tax competition and limit incentives for profit shifting (moving profits from high to low-tax jurisdictions). Potential impacts of the reforms are still unclear, but profit shifting is one of the key topics of UNU-WIDER’s project on illicit financial flows. A recent WIDER Working Paper on global profit shifting shows that within the last 50 years multinational enterprises’ profits grew faster than global profits. By 2019 10% of corporate tax revenues were lost as a result of the profit shifting (see Figure 1).

Figure 1: Corporate tax lost (% of current tax revenue)

The project also sheds light on the non-economic dimensions of IFFs, such as drugs trade, money laundering, and human trafficking. According to the latest estimates 10% of global GDP is contained in tax havens. Topics related to the project were discussed at the high-level OECD Global Forum on Transparency and Exchange of Information for Tax Purposes in Spain in November. The discussion focused on improving tax compliance and curbing offshore evasion through information exchange, with a focus on high-income groups with larger opportunities for offshore tax evasion.

Extractives, taxes, and the net zero agenda

Despite the mixed results of the COP27 meeting in Egypt, the net zero agenda is in full swing and resource-rich developing countries must adapt. Two key questions emanating from this agenda are:

(i) what are the revenue implications of the net zero agenda? and

(ii) how ‘just’ can the just transition to net zero be?

In response to the first question, fossil fuels — from which developing countries generate substantial revenues — are now being stranded while metals and renewable energy experience a boom. Resource-rich countries will need to diversify their non-resource tax bases and tap into environmental taxes. The use of carbon taxes is encouraged and is already being adopted in some countries. It is easy to see why.

Carbon emissions are a relatively unexplored tax base, have considerable revenue raising potential, and the revenues generated can be used for development or to reduce more distortive labour taxes, a change which at best could contribute to reducing the shadow economy and increase productivity growth. Taxing carbon emissions also raises the prices of fossil fuels, creating incentives to shift towards more sustainable investments and contributing to reducing fossil fuel consumption, with attendant benefits for other SDGs.

In response to the second question, there are avenues for revenue mobilization in the just transition and a low hanging fruit may be another greenhouse gas emission: methane gas. There are low-cost opportunities for cutting methane emissions —such as fixing leaks in gas pipes— and there have been successes in using tax and regulation to reduce such emissions. These questions and solutions were discussed in a Think WIDER webinar session in October.

Given the increased price of fossil fuels, another avenue will be to tax windfall profits in the energy sector. The International Monetary Fund (IMF) provides guidance on how that can be achieved. Another avenue is tackling theft, corruption and tax evasion and avoidance by multinationals in the extractive sector, all of which contrive to reduce revenue collection.

The questions of net zero economics and climate financing were presented at the conference UNU-WIDER organized on debt and innovative finance in collaboration with the Bank of Finland Institute for Emerging Economies (BOFIT) in October in Helsinki.

The voice of sub-Saharan Africa

A cross-cutting theme through all seven projects in UNU-WIDER’s DRM programme is the unique challenge of raising domestic revenue in SSA. Our recent research shows that while tax performance (tax-to-gross domestic product ratios) has been low in SSA compared to other regions, tax capacity – the broader institutional framework of tax policy - has improved since 1985. Informality is a strong contributor to low tax revenue collection in SSA.

In terms of domestic savings rates, they are low compared to other regions and there is considerable heterogeneity across the countries. Financial technology (fintech) can have galvanizing effects in mobilizing domestic savings, as Jophat Machagua highlights in his blog, but challenges, such as lack of regulation, remain. These challenges themselves are strongly linked to the underdevelopment of capital markets. Professor Njuguna N’dungu, now nominated as the Cabinet Secretary of The National Treasury and Planning of Kenya, has written a WIDER Working Paper on fintech and its linkages to domestic savings in SSA.

Things are not all gloomy, however. The IMF’s bi-annual Regional Economic Outlook for SSA shows that the region can capitalize on its endowment of renewable energy and implement fiscal frameworks which will raise substantial revenues. Furthermore, African countries played a starring role in influencing the historic shift of global tax leadership from the OECD to the UN, mentioned in the beginning of this text. While the impact of this shift is uncertain it demonstrates the kind of traction that can be gained when there is enough political commitment to an agenda.

UNU-WIDER research on DRM is appealing

At UNU-WIDER we are in the process of crystalizing the key messages emanating from the DRM workstreams and how they straddle international efforts to increase domestic revenues in the Global South.

Researchers from different workstreams have presented their findings at high level international conferences and workshops. An important contribution was UNU-WIDER’s appearance at the recent Global Development Conference. UNU-WIDER’s conference session brought up the achievements and challenges revenue authorities face in tax data work in SSA, a key area of interest under the SOUTHMOD and Building efficient tax systems workstreams. The panel comprised UNU-WIDER researchers and experts from Tanzanian, Ugandan and Zambian revenue authorities, core partners in delivering UNU-WIDER’s mandate on DRM. In addition our work on the importance of governance for tax performance, and on building data analysis collaboration were presented in sessions organised by CFP and UNDP.

As another example, at the International Conference on the Effectiveness of Development Co-operation, organised in collaboration with the European Commission in Belgium this November, a recent paper on the impact of aid fragmentation on tax revenue mobilization was presented. The paper —first of its kind— shows that aid fragmentation reduces tax revenue mobilization in developing countries.

Going forward, events worth watching out for are the DRM webinar series sessions:

- On 7 February, we present the potential of domestic savings in the Global South

The views expressed in this piece are those of the author(s), and do not necessarily reflect the views of the Institute or the United Nations University, nor the programme/project donors.

Join the network

Join the network