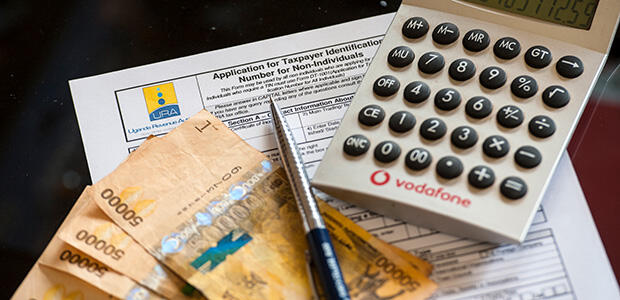

This project analyses administrative tax data to provide knowledge for better policy-making and inclusive development in selected partner countries. Using administrative data for policy analysis and research offers extensive possibilities for supporting the development of well-performing tax systems in the Global South.

Countries in the Global South have increased their tax revenue in recent decades, but overall revenues have often remained too low to sustain provision of crucially important public goods. Well-planned, efficient and equitable taxation helps to pursue economic growth, reduce inequalities, combat poverty, and provide social services.

This research project investigates how countries could develop their tax systems by improving compliance and mitigating the potential harmful effects of taxation on enterprise growth and job creation.

The project aims to develop the institutional and individual capacity of national tax administrators through technical co-operation, research co-creation, and by building national and international communities of practice around the use of administrative tax data in the Global South. The research outputs of the project are intended to assist policy makers as they develop and implement policy tools to improve development prospects in their countries.

Key questions

This project will address the following topics:

-

What are the most cost-efficient ways to ensure tax compliance?

-

How does taxation impact the size of the formal sector?

-

What does the tax data tell about different aspects of sustainable development – such as firm behaviour, social assistance distribution, and inequality?

-

How could tax regimes targeted for small and medium-sized enterprises be designed to better foster firm growth and employment?

-

How can local researchers be engaged to take advantage of tax data?

Watch this space

Calls for research using this previously unavailable data will be announced from 2022 onwards.

All papers, events, briefs, blog posts, and opportunities to engage relating to the project will be available on this webpage.

This project covers the work in selected partner countries, the information of which will be updated on these pages. The work was initiated first in Uganda in 2018, in collaboration with the research division of the Uganda Revenue Authority (URA). The Ministry for Foreign Affairs of Finland was contributing financially to this work in 2018-19.

Further collaborations have since been established in Zambia, Tanzania and Rwanda. Since 2020 the project has been a part of UNU-WIDER's programme on Domestic Resource Mobilization (DRM), with financial support from the Norwegian development agency Norad.

The ongoing collaboration in South Africa offers another example of the co-operation and research possibilities in other countries.

Improving capacities for tax and other domestic revenue collection is a key target of SDG 17. In addition, SDG 16 is dedicated to the promotion of inclusive societies with effective and accountable institutions. Furthermore, tax capacity is closely linked to the ability of governments to offer better public services to end poverty (SDG 1), reduce inequalities (SDG 10), and ensure sustainable economic growth (SDG 8). Good governance in the area of tax and social protection is a key factor in efforts to improve women and girls’ living standards as they are more dependent on efficient public service delivery (SDG 5).

Join the network

Join the network