Research Brief

The impact of tax havens on South African revenue

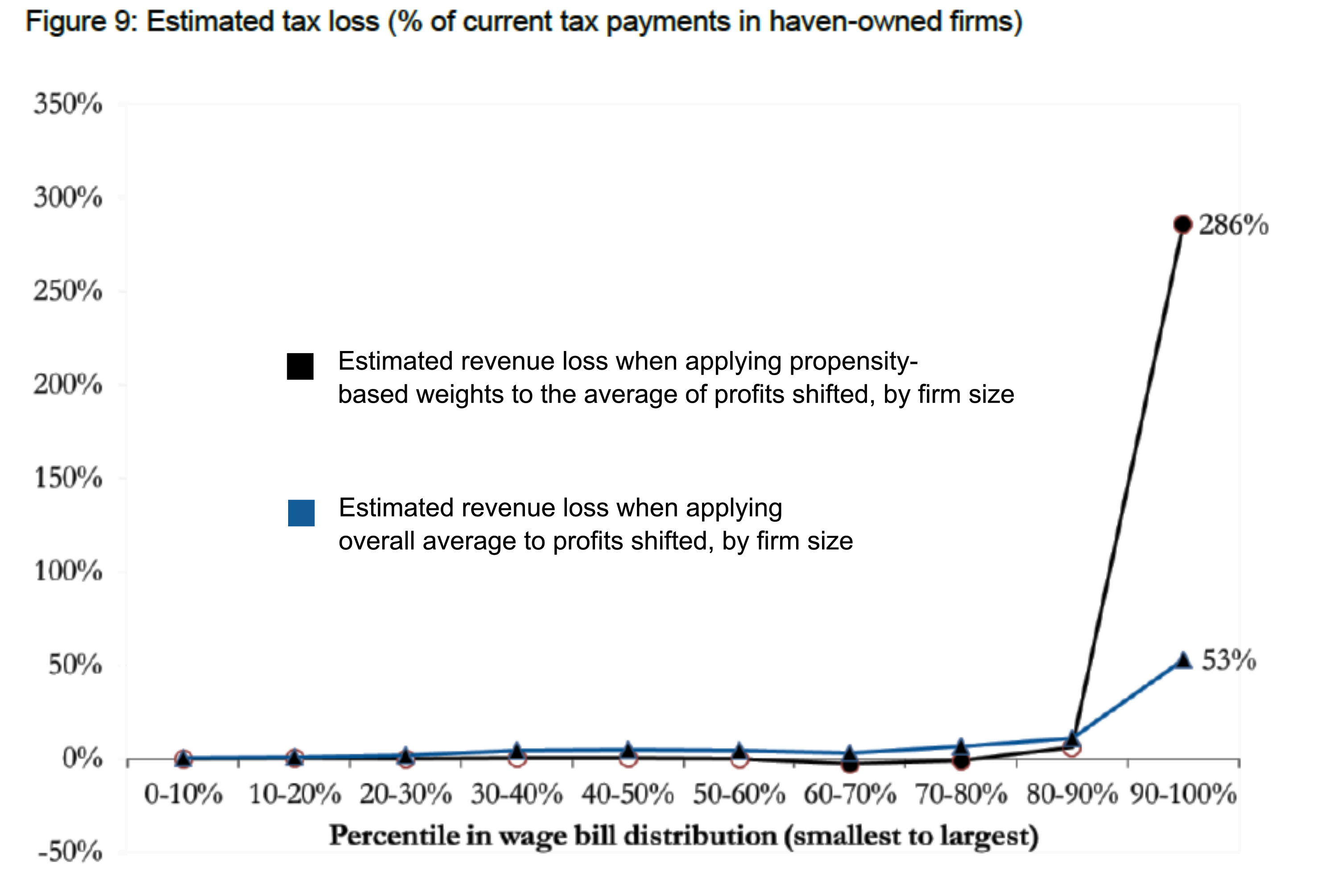

The study uses a comparative analysis of foreign-owned firms operating in South Africa to show that firms with a parent registered in a tax haven tend to report 80% less in profits than similar firms without a parent in a tax haven. This is highly suggestive, but not conclusive, evidence of profit shifting. When broken up by firm size, the data shows that the smallest half of multinationals with tax-haven affiliations do not engage in profit shifting. It is the top 10% of firms that account for 98% of the estimated volume of profit shifting. The total estimated loss represents 4% of annual corporate income tax receipts, equivalent to R7 billion or €400 million a year.

Nearly all profit shifting is done by the largest firms. The top 10% of multinational firms with affiliates in lower tax-rate jurisdictions are responsible for 98% of profit shifting

The biggest multinationals shift 78% of their profits, on average, to offshore tax havens

The estimated tax loss to South Africa is valued at R7bn per year, or nearly 4% of total corporate tax receipts

The smallest 50% of multinational firms in South Africa do not engage in profit shifting at all

Tax havens, tax avoidance, profit shifting, and corporate tax planning have been a part of the modern lexicon ever since the leaking of the now infamous Panama Papers. These practices have only increased with the continuing globalization of the modern economy, raising important questions about fairness and economic development.

For example, do tax havens make it easier for multinational corporations to pay less than their fair share in the nations where they operate? How does that impact nations who need tax revenue to develop their economies and improve the lives of their citizens? And, if we could identify the companies that shift profits would it be easier for governments to collect revenue from them?

Averages can be deceiving

South Africa has about two thousand foreign-owned firms operating in its economy, but these firms represent nearly 30% of total sales. These companies are big players in the economy, having doubled their share of the economy over the last 25 years. This means that even a small amount of profit-shifting activity by these firms can quickly represent a significant loss of revenue for South African authorities.

Since they are some of the largest enterprises in the economy, the total loss to the South African government is larger than the loss would be if all firms shifted profits at the average rate. By disaggregating firms by firm size and applying an estimated rate proportional to their firm size’s propensity to shift profits, the study advances research on tax avoidance globally.

Globally, the standard method for estimating profit shifting applies an average rate of profit shifting to all firms in order to estimate the aggregate loss caused by offshore tax havens. In this study, the methodology was updated to reflect the finding that different sized firms behave differently. The method used adjusts the rate applied according to the actual frequency of profit shifting indicated by tax data for firms of different sizes.

variable (tax loss) using different methods

Doing this reveals that research using overall averages might underestimate the scale of the problem globally by as much as 80%. For states in the Organisation of Economic Co-operation and Development (OECD), previous studies may have underestimated the scale of profit shifting by about 40% on average.

OECD estimates from the Base Erosion and Profit Shifting (BEPS) initiative, which aims to reduce revenue losses that result from international tax leaks, could be improved by accounting for how different sized firms behave differently.

Revenue loss

In South Africa, 19% of tax revenues come from corporate income taxes. Addressing the underreporting of corporate income by large multinationals with offshore affiliations could increase these tax receipts by 4% of their total, a benefit to the South African fiscus of approximately R7 billion a year.

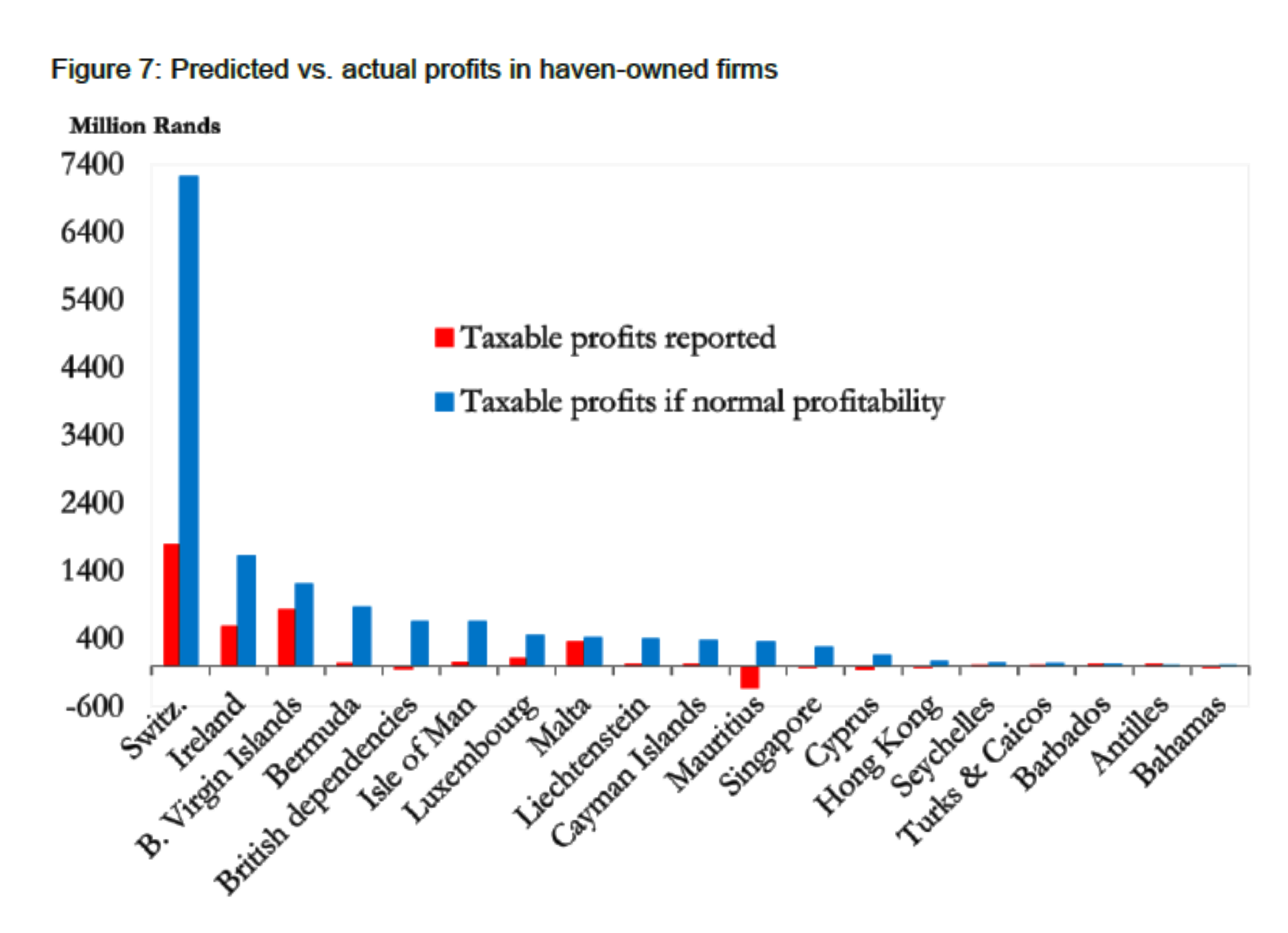

The research indicates that the firms most likely to shift large amounts of profits are the largest 10% (by wage bill, fixed assets, and/or turnover). Among these, the biggest profit shifters by industry are those in the resource extractives industry, which account for 28% of the problem. Firms in the financial industry are second, accounting for 19% of the gap. Fifty per cent of the estimated profit-shifting activity is by multinationals owned by a parent affiliate registered in Switzerland.

Implications for fair competition

Efforts to curb profit shifting should start with a focus on the very largest firms

Curbing profit shifting might help to level the playing field. Tax havens erode the tax base, but also they distort competition by creating a de facto tax benefit for only the largest companies

Special attention should be given to firms operating in the extractive and financial industry where estimates indicate the tax loss is largest

Implementing OECD BEPS measures, revisiting treaties, and increased auditing of the very largest companies are some of the measures that could be taken

As larger firms are more likely to shift profits offshore, the paper argues that they receive a ‘de facto tax benefit’ that other companies do not have access to. In addition to reducing public revenues, this might also have negative implications for fair competition, representing an advantage for firms with increased levels of market concentration.

Join the network

Join the network