Working Paper

Top income adjustments and tax reforms in Ecuador

Top income under-coverage in developing countries not only leads to downward biased inequality indicators but might also affect the ex-ante evaluation of progressive tax reforms. We propose a simple adjustment to top incomes for formal employees (e.g...

Working Paper

How have formal firms recovered from the pandemic?

This paper examines how formal firms have been impacted by and recovered from the pandemic by drawing on two distinct but complementary data sources. This is the first attempt to use both survey and tax administrative data to measure the initial...

Working Paper

Exclusive growth?

Despite South Africa’s need for inclusive economic growth, we find that the income trajectories of the rich continue to diverge from the rest of the income distribution. We combine household survey data and tax data (which, unlike household survey...

Working Paper

Earnings in the South African Revenue Service IRP5 data

The IRP5 and IT3(a) tax data from the South African Revenue Service have been made available to researchers through a joint project between the South African Revenue Service, the National Treasury, and UNU-WIDER. In this paper, I explain how to use...

Working Paper

What explains the gender gap in top incomes in developing countries?

Based on tax records data from Ecuador, we analyse gender differences in top income groups from 2008 to 2017. Ecuador represents an interesting case as it shares many trends with other countries in the region in terms of women’s status in the labour...

Background Note

Building tax data for research

Introduction: data for development Globally, one of the key factors associated with increasing use of data to inform policy-making has been the increased availability of new administrative data sources. In 2014, the National Treasury of South Africa...

Technical Note

Government Revenue Dataset (2021): country notes

This technical note is the third in a series based on the UNU-WIDER Government Revenue Dataset (GRD). The preceding notes have described in detail the variables contained within the GRD and the source selection procedures. In this technical note, we...

Working Paper

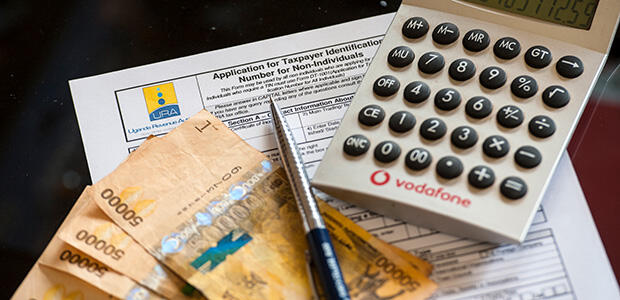

Income distribution in Uganda based on tax registers: what do top incomes say?

We use income data from tax registers at the Uganda Revenue Authority from 2011 to 2017 to estimate top income inequality, focusing on the very top—the top 1, 0.1, and 0.01 per cent of the income distribution. The focus on the extreme top is...

Technical Note

The Uganda Revenue Authority firm panel

This technical note describes the Uganda Revenue Authority (URA) firm panel, which is constructed from administrative corporate income tax (CIT) returns and firm registration data for the financial years 2013/14–2019/20. The panel dataset contains...

Blog

The tortoise defeats the hare: Does moderate outlast rapid growth in domestic revenue?

by

Annalena Oppel, Kyle McNabb

February 2022

The past four decades have seen marked improvements in the collection of domestic revenue (tax and non-tax revenues) in many countries of the Global...

Technical Note

Government Revenue Dataset (2021): source selection

This technical note is part of a series of technical notes describing the construction of the Government Revenue Dataset (GRD). We provide an overview of the underlying sources in the GRD and the criteria used in order to select data from them. In...

Technical Note

Government Revenue Dataset (2021): variable description

This technical note is part of a series of technical notes describing the construction of the Government Revenue Dataset (GRD). This document specifically focuses on the composition of variables in the GRD (version August 2021) and across the...

Working Paper

The guide to the CIT-IRP5 panel version 4.0

This paper presents version 4.0 of the CIT-IRP5 firm-level panel dataset. Version 4.0 is the latest edition of the firm-level component of the combined administrative data using sources from the South African Revenue Service. We show that differences...

Technical Note

Top income adjustments and tax reforms in Ecuador: an application of ECUAMOD

This technical note has been produced alongside a WIDER working paper assessing the effects on income inequality and income tax simulations of adjusting top incomes of employees in survey data based on administrative tax records in Ecuador. The paper...

Join the network

Join the network