Policy Brief

Fiscal multipliers and debt dynamics using a DSGE approach

Much of the research on the impact of fiscal policy shocks on macroeconomic outcomes (e.g., fiscal multipliers) uses reduced-form modelling approaches such as vector auto-regressions to obtain empirical results. In a recent study1, we used this approach to estimate fiscal multipliers for South Africa. Here, we use a different approach to identify shocks to government spending and taxes and to explore the consequences of fiscal policy decisions on economic ouput.

Government consumption and investment multipliers are generally positive and smaller than one

Government investment has larger and more persistent positive effects on output

Labour taxes have the most distortionary effect on output and private consumption

Increases in capital taxes induce a positive long-run (revenue) effect on output because public investment acts as a complement to private investment

The most effective instruments for stabilizing debt are reductions in government consumption spending and, to a lesser extent, increases in consumption taxes

We specify and estimate an open-economy fiscal dynamic stochastic general equilibrium (DSGE) model for the South African economy. Consistent with the empirical literature, we find that government consumption spending (which includes public wages) and investment multipliers for output are generally positive – and smaller than one – but that tax multipliers are often negative, with the greatest impact on private consumption. The size of the impact of tax shocks on real GDP is, however, ambiguous and depends on how different fiscal instruments respond in order to stabilize debt in the DSGE model.

The model also contains several features that make it suitable for fiscal policy analysis, including the ability to measure the response of economic output and public debt levels from discretionary fiscal policy decisions. Policy instrument simulations suggest that reducing government consumption spending and, to a lesser extent, raising consumption taxes are the most effective instruments for stabilizing growing debt, while cuts to government investment are not as effective.

Results

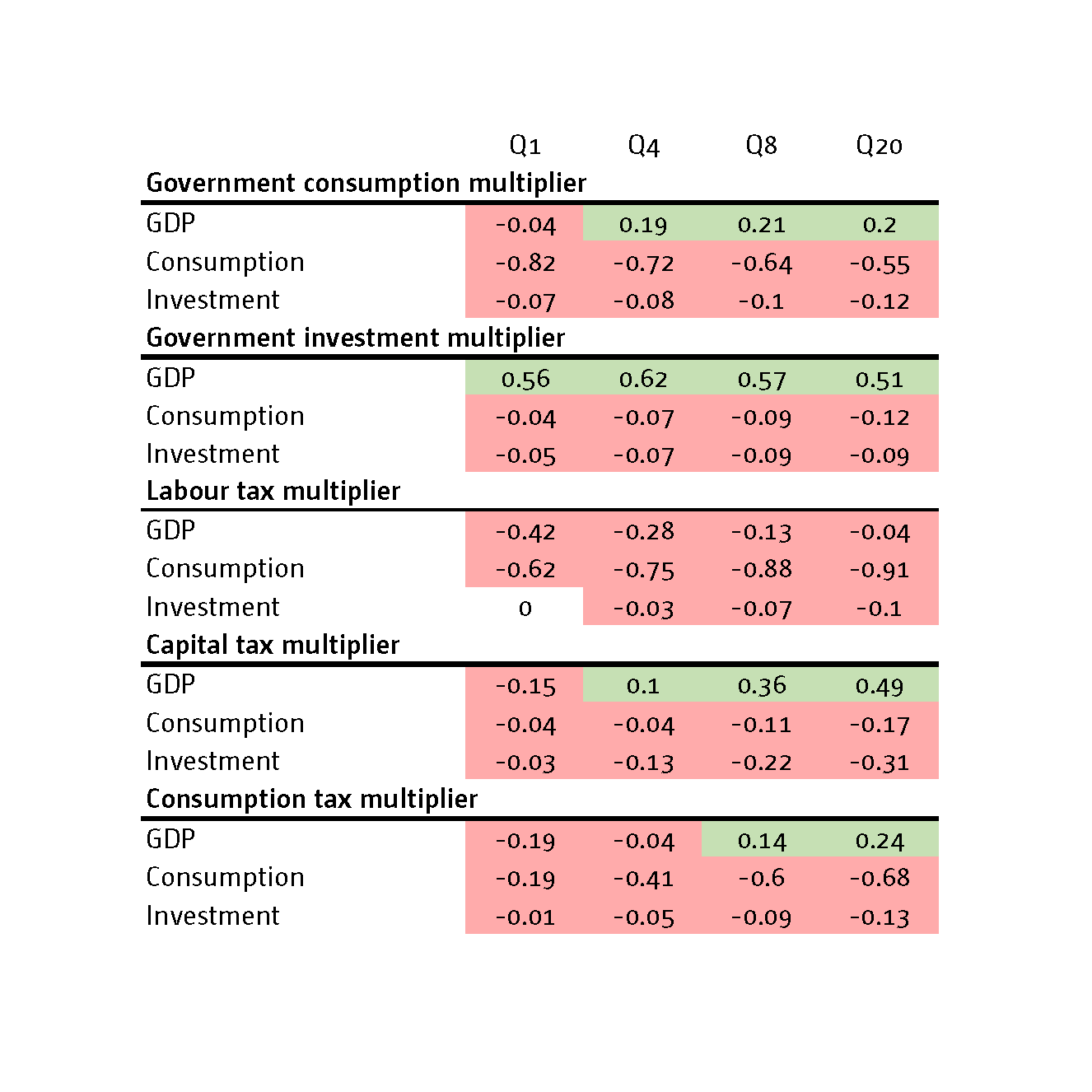

We present our results as present-value fiscal multipliers (Table 1). Overall, the multipliers estimated using the DSGE model are generally smaller than estimates from reduced-form models. There are three reasons for this result. Fiscal multipliers are often found to be smaller in open-economy settings, in models that control for fiscal feedback mechanisms (automatic stabilizers), and in models that assume rational actors (optimal long-term decisions by households and firms).

Table 1: Present value multipliers for South Africa2

Notably, increases in government investment produce the largest and most persistent positive effects on real GDP (up to 62 cents per additional rand spent) and increases in labour taxes have the largest negative effect on private consumption (up to 91 cents per rand collected). By contrast, government consumption has a negligible impact on real GDP and an increase in capital taxes actually improves real GDP in the long term.

The key reason that the multiplier for government investment is larger than the multiplier for government consumption is that public consumption crowds out both private consumption and investment (up to 82 cents and 12 cents per rand, respectively), whereas government investment complements private investment. Finally, since government investment expenditure has both the largest positive effect on output and the least distortionary effect on private consumption and investment (up to 12 cents and 9 cents per rand, respectively), it should be considered the most effective form of fiscal stimulus.

We use the DSGE model to assess fiscal policy instruments for debt stabilization too (Figure 1). This is accomplished by modelling a positive, one standard deviation change in government consumption spending (simulating deficit spending), followed by a hypothetical counter-acting fiscal policy response (simulating an attempt to finance the deficit created). The results indicate how quickly total debt will stabilize, depending on the type of fiscal policy instrument used to finance it (a spending cut or tax increase).

Figure 1: Debt-stabilization dynamics3

We also use the model to demonstrate the impact of automatic stabilizers (the response of fiscal instruments to changes in real GDP) on government debt after a budgetary shock (Figure 2). This follows from the fact that the costs (or returns) of fiscal policy instruments are dependent on the state of the economy (for example, a tax on consumption will earn less revenue during a downturn). Consistent with the literature, we find that stronger automatic (countercyclical) responses reduce the accumulation of debt during a deficit spending drive.

Figure 2: The role of automatic stabilizers in debt-stabilization

Concluding remarks

The most effective tool for debt stabilization appears to be cuts to government consumption spending, followed by increases to labour and consumption taxes. But because the multiplier results indicate that increased taxes on labour have a large and persistently negative impact on real GDP, we recommend some measure of consumption tax increases instead. The multiplier results also indicate that public investment spending has a non-trivial positive impact on real GDP, presenting a fiscal policy mix for South Africa that includes a government investment-driven stimulus alongside debt-stabilization. The results suggest further that capital tax increases could partially finance this, since the long-run effect of this instrument on output is positive and crowding-out of private consumption and investment appears minimal (see Table 1).

For fiscal consolidation, cuts in government consumption expenditure combined with consumption tax increases presents a possible fiscal policy mix

For fiscal stimulus, government investment expenditure has both the largest effect on output and the least distortionary effect on private consumption and investment

The results also suggest that capital tax increases could partially finance an investment driven fiscal stimulus

The literature on optimal fiscal policy derives two stylized results. First, small, permanent changes to fiscal instruments are preferred to large, sudden changes. Second, mild countercyclical policies can have both stabilizing and welfare enhancing effects. Together with these insights, our results can help inform the current fiscal consolidation drive of the National Treasury in South Africa.

Join the network

Join the network