Blog

Is there a silver lining to COVID-19? The effects of government responses on financial inclusion

The toll of the COVID-19 pandemic is still being assessed. Meanwhile, new variants continue to threaten as the reservoir of infected people remains large enough for mutations to proliferate. Excess deaths, a global measure, are estimated at 14.9 million for 2020–21 by the World Health Organization.

With this immense suffering, is there a ray of hope? One place to look is the pandemic’s impact on deepening financial inclusion —more families owning accounts with banks or other formal institutions. After all, governments responded by providing support to family finances, often through digital transfers that may have encouraged recipients to formalize their finances.

Greater financial inclusion has several benefits. Account holders can more easily smooth consumption and manage economic risks; banks can arbitrage between savers and investors; governments can expect increased investment in the economy and better information on the funds circulating, useful for macroeconomic management.

A relevant question, then, is if governments' responses to the pandemic —with digital transfer programmes— improve financial inclusion?

Analysis of the effects on financial inclusion

Several institutes curate data on the government programmes implemented in response to COVID-19, including the World Bank (see Gentilini 2022, Gentilini et al 2021, and Marin & Palacios 2021). I used their database to mark whether a country has any digital transfer programmes, then collated the last three global financial inclusion surveys: the Global Findex 2014, 2017, and 2021. My study analyses 146 countries and nearly 415,000 people.

To estimate the impact of COVID-19-related digital transfers on financial formalization, one can apply a difference-in-differences estimator using the available information before and after the pandemic started in 2020. The estimator assumes parallel trends in financial inclusion for countries with and without such transfers. These trends have not moved side-by-side in the past seven years, however, so I applied a doubly robust version in which the results are balanced with information on society’s readiness for such programmes (digital adoption index in 2014), which accompanies the 2016 World Development Report. Three outcomes are important: an account in banks, an account in any formal financial institution, and as mobile money.

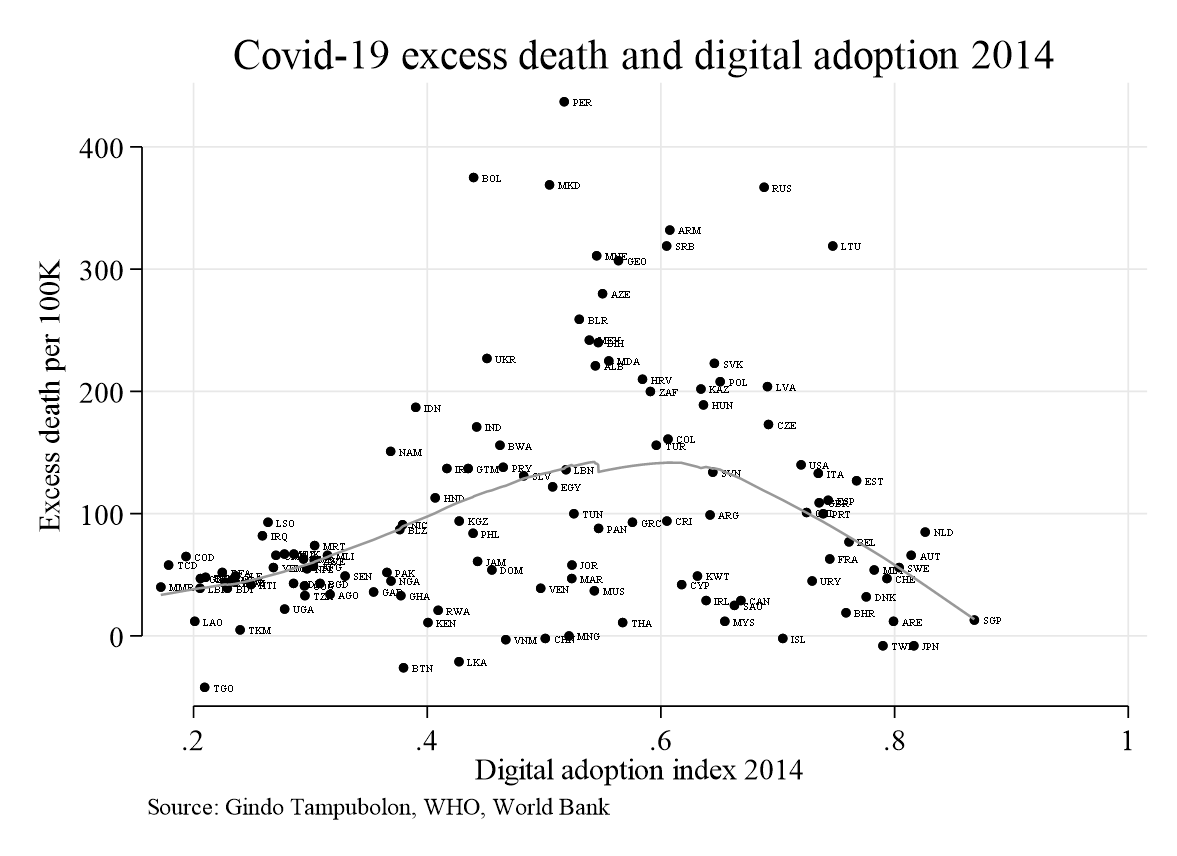

Digital readiness in 2014 and excess death in 2020–2021

Countries were hit by the pandemic at different levels of digital readiness. Interestingly, I found that higher initial digital readiness relates to lower excess death later in the pandemic, but only if a country’s digital readiness is above the median (Figure 1). Beyond the median, excess death follows a steeper decline. The pandemic shows that governments and society deliver transfers and various supports using digital technology, evident in the relationship between digital readiness and excess deaths.

Figure 1. Semiparametric relation between excess death and initial digital readiness

Financial inclusion in the pandemic’s wake

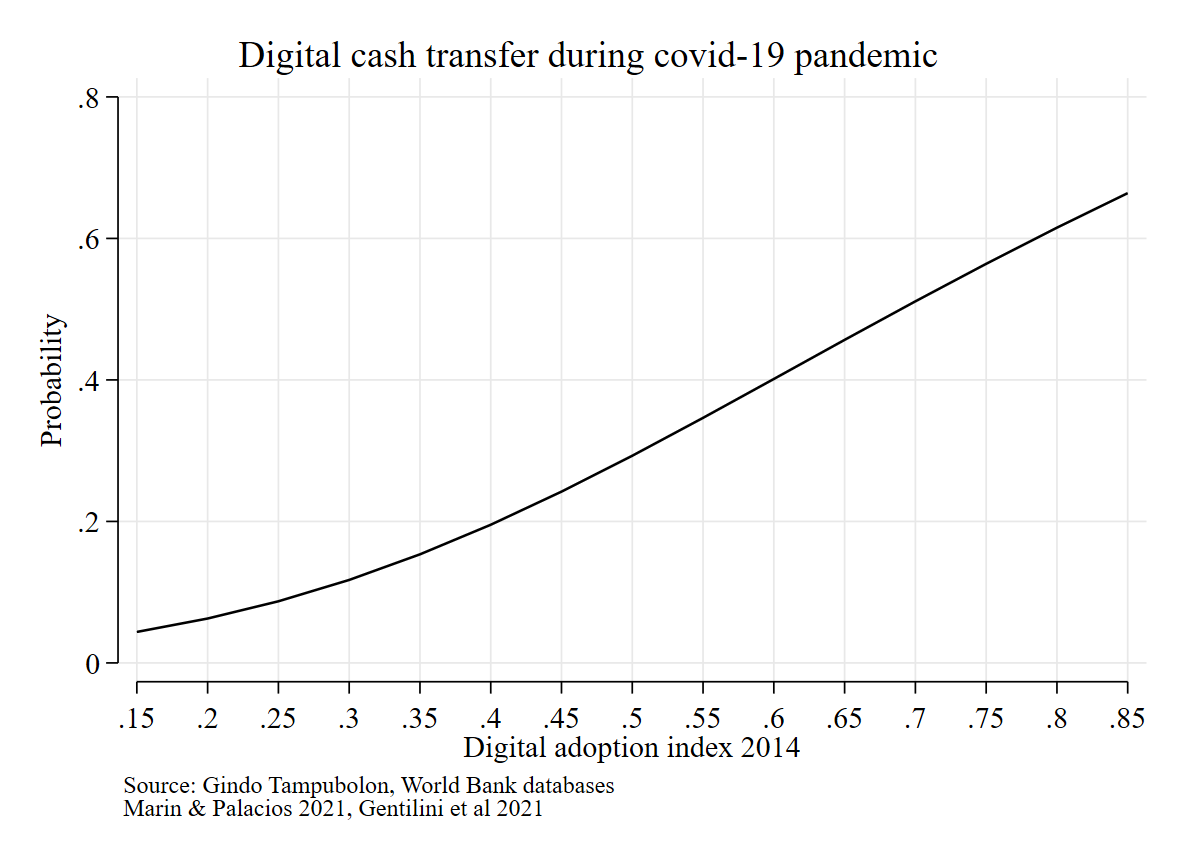

Because transfer programmes were delivered through digital means in some countries, but not others, what impact do they have in other matters such as financial inclusion? I first check whether countries’ readiness indeed relates to delivering support via digital transfers. The marginal plot shows that the relation is positive —greater digital adoption is associated with a higher probability of digital transfers in 2020–2021.

Figure 2. Marginal plot of probability of digital transfer on digital adoption

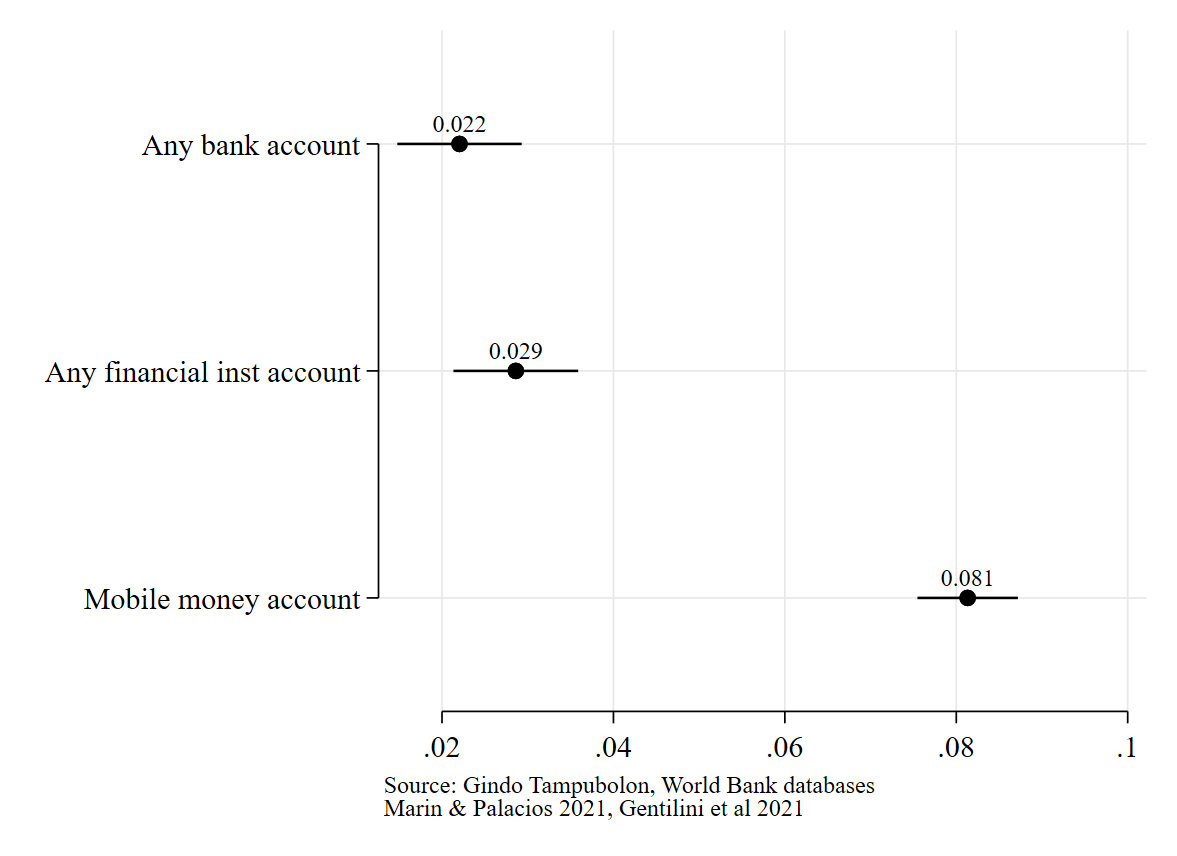

Finally, putting all this together, the data show that if a government implemented a digital transfer programme in response to COVID-19, it indicates a 2%–8% increase in the subsequent financial inclusion of the population. The coefficient on owning any bank account was around 2%, and 8% on owning a mobile money account in the wake of the pandemic (Figure 3) for countries with digital transfer programmes relative to countries without.

Figure 3. Digital transfer impact during the COVID-19 pandemic on subsequent financial inclusion

Perhaps this deepening of financial inclusion is a ray of hope amid the immense suffering. Governments, businesses, and families can draw benefits from being part of a more inclusive financial system.

Gindo Tampubolon is a senior lecturer in global health at the Global Development Institute – University of Manchester, and a visiting scholar at the United Nations University – World Institute for Development Economics Research.

The views expressed in this piece are those of the authors, and do not necessarily reflect the views of the Institute or the United Nations University, nor the programme/project donors.

Join the network

Join the network