Working Paper

How large is the wage penalty in the labour broker sector?

Public debate on the temporary employment services, or labour broker, sector in South Africa has focused on temporary workers’ wages and benefits. Empirical research is limited: temporary employment services cannot be accurately identified in recent...

Working Paper

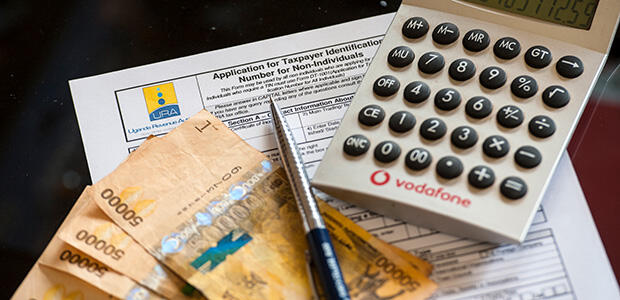

Taxpayer response to greater progressivity

We evaluate a major personal income tax reform in Uganda that came into effect in 2012–13, contributing to the scarce literature on the effects of personal income tax reform on employees’ income in a low-income country in Africa. The reform increased...

Working Paper

How have formal firms recovered from the pandemic?

This paper examines how formal firms have been impacted by and recovered from the pandemic by drawing on two distinct but complementary data sources. This is the first attempt to use both survey and tax administrative data to measure the initial...

Working Paper

Top earners and earnings inequality during the COVID-19 pandemic

This paper aims to assess the extent to which top earners in Ecuador were affected by the COVID-19 crisis compared to other segments of the population.Our analysis uses administrative data for individuals affiliated to social security between January...

Working Paper

Estimating the distribution of household wealth in South Africa

This paper estimates the distribution of personal wealth in South Africa by combining tax microdata, household surveys, and macroeconomic balance sheet statistics. We systematically compare estimates of the wealth distribution obtained by direct...

Working Paper

What explains the gender gap in top incomes in developing countries?

Based on tax records data from Ecuador, we analyse gender differences in top income groups from 2008 to 2017. Ecuador represents an interesting case as it shares many trends with other countries in the region in terms of women’s status in the labour...

Background Note

Building tax data for research

Introduction: data for development Globally, one of the key factors associated with increasing use of data to inform policy-making has been the increased availability of new administrative data sources. In 2014, the National Treasury of South Africa...

Blog

Ending aid dependency: Taxation in developing countries can be improved through collaboration

Finland aims to raise the amount of its development assistance to 0.7% of GDP, and this goal has good grounds. But how can we make sure that the...

Technical Note

The Uganda Revenue Authority firm panel

This technical note describes the Uganda Revenue Authority (URA) firm panel, which is constructed from administrative corporate income tax (CIT) returns and firm registration data for the financial years 2013/14–2019/20. The panel dataset contains...

Working Paper

The guide to the CIT-IRP5 panel version 4.0

This paper presents version 4.0 of the CIT-IRP5 firm-level panel dataset. Version 4.0 is the latest edition of the firm-level component of the combined administrative data using sources from the South African Revenue Service. We show that differences...

Technical Note

Total factor productivity in South African manufacturing firms 2010–17

We update Kreuser and Newman’s (2018) total factor productivity estimates for the South African manufacturing sector using administrative data from 2009–17. We use standard implementations of the Ackerberg et al. (2015) and Wooldridge (2009)...

Blog

Co-creation for fair and efficient taxation: Research recommendations to improve policies

by

Maria Jouste, Tina Kaidu Barugahara, Nicholas Musoke

August 2021

How can we determine the taxation of wage earners or multinational corporations in a fair manner? Will simplifying tax administration help increase...

Blog

Data access for economic growth in Africa

Sub-Saharan Africa has abundant natural resources and a substantial market, with an estimated population of 1.2 billion. The population is projected...

Technical Note

The Uganda Revenue Authority trade data

This Technical Note describes Ugandan trade data covering import and export declarations for ten calendar years from January 2013 to December 2022, constructed from transactional-level Ugandan administrative data. The trade data series contains...

Working Paper

The dynamics of formal employment during and after the COVID-19 pandemic in Uganda

This paper studies the impact of the COVID-19 pandemic on formal sector employment in Uganda. Utilizing employee-level administrative tax data from the Uganda Revenue Authority, we describe the dynamics of employment as the pandemic evolved, seeking...

Join the network

Join the network