Blog

Employing young people in South Africa: What role has the Employment Tax Incentive played?

by

Itumeleng Makgetla

March 2017

South Africa has some of the highest rates of joblessness in the world and youth unemployment is particularly severe. Roughly two in five young South...

Working Paper

Assessing pension-related tax expenditures in South Africa

In 2016, the South African government introduced a comprehensive reform to simplify and harmonize the pension system in order to incentivize pension savings and increase the fairness of the retirement system. Using administrative tax micro-data, we...

Working Paper

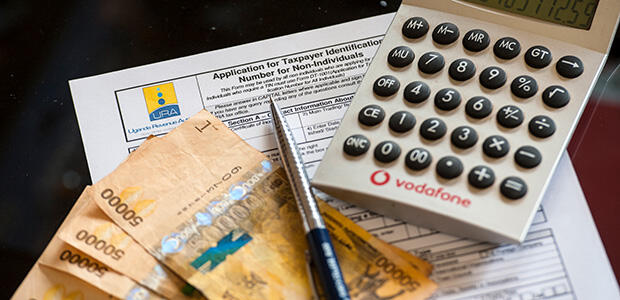

Did Uganda’s corporate tax incentives benefit the Ugandan economy or only the firms?

Uganda has one of the lowest corporate income tax collection rates in sub-Saharan Africa, while offering generous corporate tax incentives. It is unclear whether tax incentives achieve their objectives without primarily benefiting firms, potentially...

Workshop

UNU-WIDER supports learning at the Addis Tax Initiative regional workshop on tax expenditures

UNU-WIDER Research Fellow Amina Ebrahim joins the Addis Tax Initiative (ATI) Asia regional follow-up technical meeting on tax expenditures in Kathmandu, Nepal as a presenter.

Tue, 7 May 2024

–

Thu, 9 May 2024

Hotel Yak & Yeti,

Durbar Marg, Kathmandu 44600, Nepal,

Kathmandu,

Nepal

Past event

Join the network

Join the network