News

The first-ever bundle of microsimulation models for the Global South released

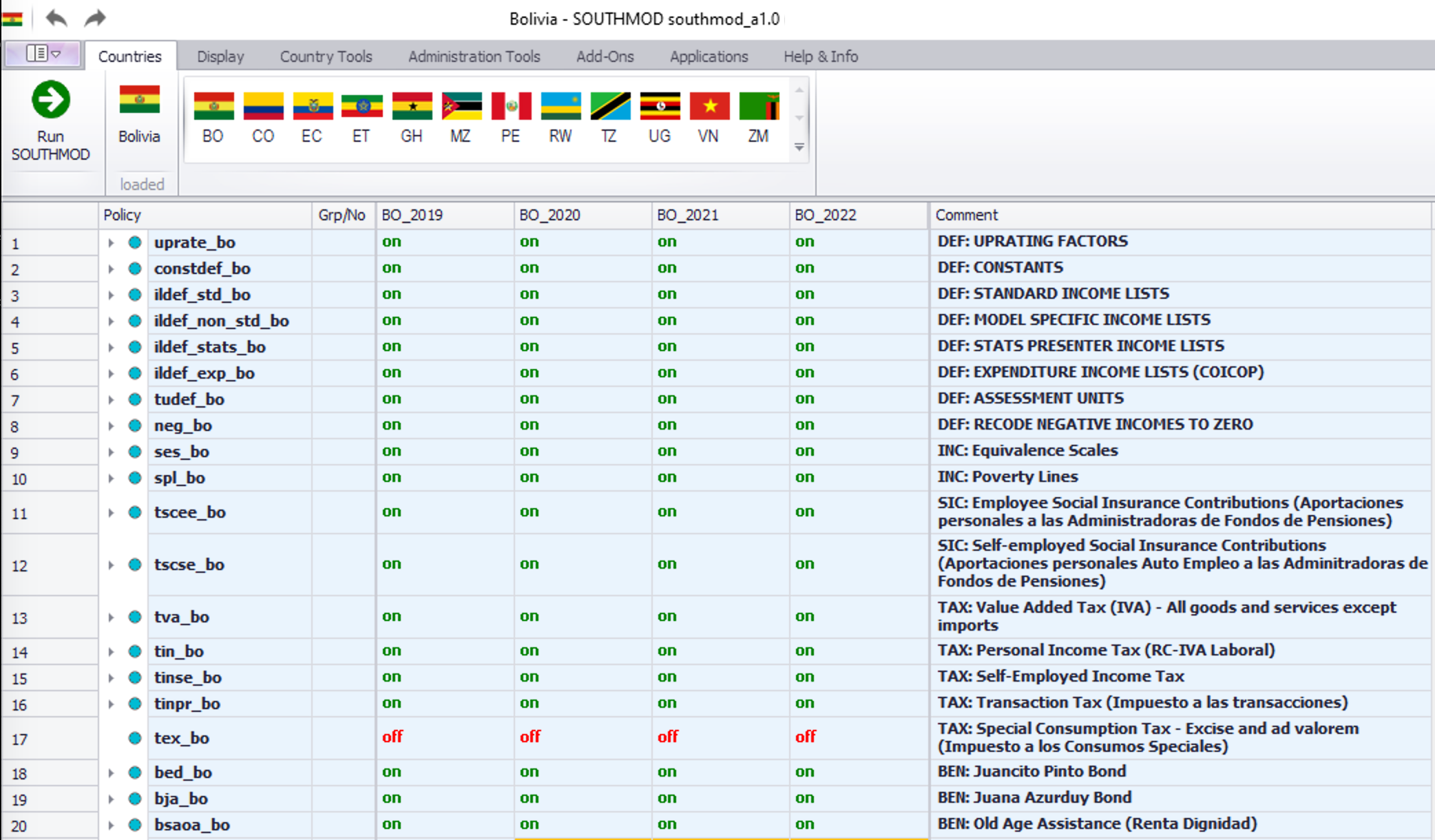

The SOUTHMOD bundle compiles tax-benefit microsimulation models for 12 developing countries into a single platform, drawing inspiration from the tax-benefit microsimulation model for the European Union, EUROMOD.

UNU-WIDER’s SOUTHMOD project aims to develop and promote tax-benefit microsimulation models in the Global South. Building on the success of EUROMOD, a model designed for EU member states, SOUTHMOD facilitates rigorous policy analysis and fosters the creation of evidence-based tax and social benefits policies in the developing world.

Each SOUTHMOD model enables the assessment of various tax and social protection policies and related reforms, with the goal of creating better understanding of their impact on household incomes, poverty, inequality, and the government budget. The models have proven to be beneficial for both researchers and policymakers, and their advantages will be further amplified by releasing them in a harmonized and integrated format.

The bundle, officially called SOUTHMOD_A1.0, brings together all microsimulation models developed by UNU-WIDER and its partners from the past decade. The models are currently available for seven countries in Africa (Ethiopia, Ghana, Mozambique, Rwanda, Tanzania, Uganda, Zambia); four in Latin America (Bolivia, Colombia, Ecuador, Peru); and one in Southeast Asia (Viet Nam). The models in this release include tax and benefit policies up to 2022 for all countries, and they will be updated regularly.

The bundle is freely available for non-commercial research use. The model release is accompanied by the publication of the first unified SOUTHMOD User Manual and updated country reports, describing the modelled tax-benefit policies in each country.

Furthermore, with this release, Rwanda, Bolivia, Colombia, and Peru will join the SOUTHMOD family, with their respective models becoming available to the public.

New opportunities for policy analysis and comparative research

The first SOUTHMOD bundle is a culmination of rigorous model development and harmonization work by UNU-WIDER, Southern African Social Policy Research Insights (SASPRI), the International Inequalities Institute at the London School of Economics and Political Science (LSE), and national teams based at government institutes and universities in respective host countries.

Relying on the capabilities of the EUROMOD modelling platform, the SOUTHMOD bundle offers several benefits for researchers and policy analysts, including:

- working with several country models at the same time

- copying and evaluating tax-benefit policies from one country to another

- conducting comparative research across countries

- analysing model outcomes in a common currency, international dollars, accounting for differences in the costs of living

Both the configuration of policies and the input data used in the models, derived from nationally representative household surveys, have been harmonized to enable meaningful comparisons between countries. The idea is that all models in the SOUTHMOD project—and now in the bundle—are based on the same assumptions and conventions.

These conventions are also linked as closely as possible with those of the EUROMOD models. In principle, this makes it possible to include European countries in such comparative analyses as well.

Notwithstanding the new opportunities related to cross-country comparisons, the bundle does not prevent users from focusing exclusively on their country of interest and, for instance, analysing model outputs in a local currency.

Join the network

Join the network