Blog

Good intentions falling short – the case of pension-related tax expenditures in South Africa

Tax benefits to boost contributions into pension funds or pension-related tax expenditures (PTEs) are used widely by governments worldwide to address issues related to the aging of population and the sustainability of retirement systems. Although these goals are worth pursuing, PTEs are often highly regressive and can thus be important drivers of inequality trends.

In South Africa, for instance, PTEs are one of the largest tax expenditure provisions and their benefits are disproportionally captured by top-income earners, which exacerbates the strikingly high level of inequality in the country.

Reform of pension systems is urgent

Population aging is accelerating worldwide and has significant socioeconomic implications, including a decline in the size of the labour force, an increase in the age-dependency ratio, and a redistribution of income and wealth.

Against this background, the redesign of pension systems tops the priority list for policy makers around the globe who aim to shift the provision of retirement income away from the public sector and towards private savings. The key thrust has been to move from ‘pay-as-you-go’ (PAYG) systems, where pensions to retired workers are financed by the contributions of active workers, usually via payroll taxes, to funded systems, where contributions are accumulated in workers’ individual accounts along with earnings on these assets, and the total amount of contribution at retirement is converted into a pension annuity.

A widely used, yet questionable option

Tax incentives are one of the main policy instruments used by governments worldwide to boost pension savings. Yet, the fiscal cost of PTEs can be significant. More importantly, and alarmingly, PTEs are often ineffective at their stated aim of boosting savings and can exacerbate inequality. The case of South Africa provides an illustration.

A lost opportunity in the 2016 retirement reform

In a recent WIDER Working Paper , Chris Axelson and I look into the 2016 retirement reform in South Africa. The reform was meant to simplify and harmonize the pension system to further incentivize savings and increase fairness. Using the individual panel created by Ebrahim and Axelson (2019) based on administrative tax micro-data made available through the Southern Africa – Towards Inclusive Economic Development (SA-TIED) programme, we find i) positive effects of the reform on both the number of contributors to pension funds (extensive margin) and the average value of contributions (intensive margin) but, on the other hand, ii) no effect in mitigating the regressive impact of PTEs.

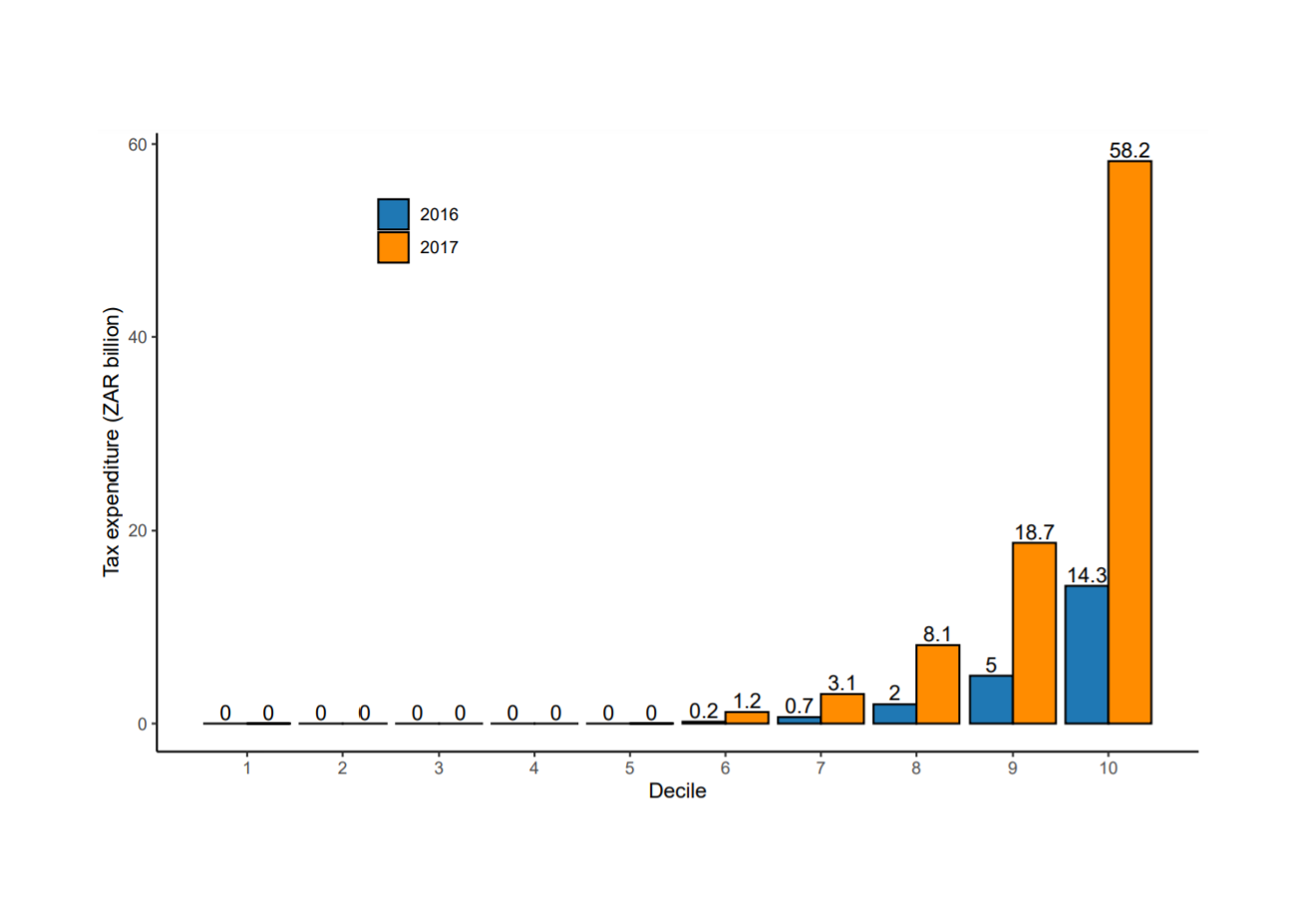

Indeed, if anything, the reform exacerbated inequality. Why? First, the behavioural response to the reform was larger for higher-income earners. Second, as shown in Figure 1, the striking concentration of PTEs remained stable (the top 20% of earners capture more than 80% of the benefits both before and after the reform) while the resources allocated to PTEs—which are the largest tax expenditure provision in the country and account for 1.7% of GDP—increased considerably. For the sake of correctness, part of the increase in the fiscal cost of total PTEs observed in Figure 1 is explained by the availability of more data, since data on employer contributions started to be collected only for the post-reform period. Yet, the fiscal cost of the tax benefits for those contributions that remain fully comparable did increase considerably.

The concentration of these benefits among higher-income households is striking, even more so in view of the high inequality levels the country already faces.

Figure 1: Total pension-related tax expenditure by taxable income decile

Context and design are vital

To mitigate the distributional bias of these benefits, a closer look at their concrete design and context is critical.

To start with, 34% of South Africa’s workers are employed in the informal sector. As a result, many of those in lower-income brackets cannot be reached by any policy implemented through the tax system. Moreover, as is often the case, PTEs in South Africa are granted as a deduction from taxable income. Benefits therefore accrue only to households with a taxable income above the tax-free threshold. For this reason, deductions are particularly regressive and tend to increase with marginal tax rates and, hence, with income.

In South Africa, the tax-free threshold lies at ZAR75,750 which is above the income of the bottom 40%. Switching to refundable tax credits would bring these households into the group of beneficiaries and thus mitigate the regressive impact of the scheme.

The devil is in the details

Introducing an effective cap on the deductible amount is a further step to take. In South Africa, the ZAR350,000 cap introduced in 2016 had no effect. Again, poor design is likely to be blamed for this. The ZAR350,000 cap is more than 13 times the median disposable income (and 7.7 times the median gross yearly wage) in South Africa. To compare, tax-deductible contributions to pension funds are capped at CHF6,768 in Switzerland, an amount accounting for 13% of median disposable income (less than 9% of median gross yearly wage).

Boosting pension savings is a goal worth pursuing, but costly and regressive tax deductions are not the way to go. Ill-designed PTEs are likely to be limited in their effectiveness, exacerbate inequality, and significantly affect government budgets. To ensure they support their stated goals, context and design are crucial—in South Africa as well as everywhere else.

Agustin Redonda is a Senior Fellow with the Council on Economic Policies where he focuses on fiscal policy. He has also worked with the Organisation for Economic Co-operation and Development (OECD) and for the National Plan to Reduce Informal Activity (PNRT) at the Ministry of Labour, Employment and Social Security (MTSS) in Argentina.

The views expressed in this piece are those of the author(s), and do not necessarily reflect the views of the Institute or the United Nations University, nor the programme/project donors.

Join the network

Join the network