Research Brief

New estimates on the share of tax evasion in Zambia

Zambia is putting in place fiscal measures to improve the efficient collection of domestic revenue to finance social and public infrastructure. This analysis shows how much more revenue can be accumulated if tax evasion was at the bare minimum.

Tax gap describes the share of the potential tax revenue lost due to non-compliance. The parameter helps to address the policy question of whether to mobilize more revenue by better enforcement of existing taxes or by increasing tax rates

In a new type of analysis, tax audits on value-added tax (VAT) and corporate income tax (CIT) were used to predict the tax evasion for all firms in the Zambian tax net from 2014–2020. The results indicate the total tax gap to be between 47% and 56%, depending on the specific approach

The results suggest that there is clear revenue potential in enforcing revenue mobilization by better enforcement of existing taxes in Zambia

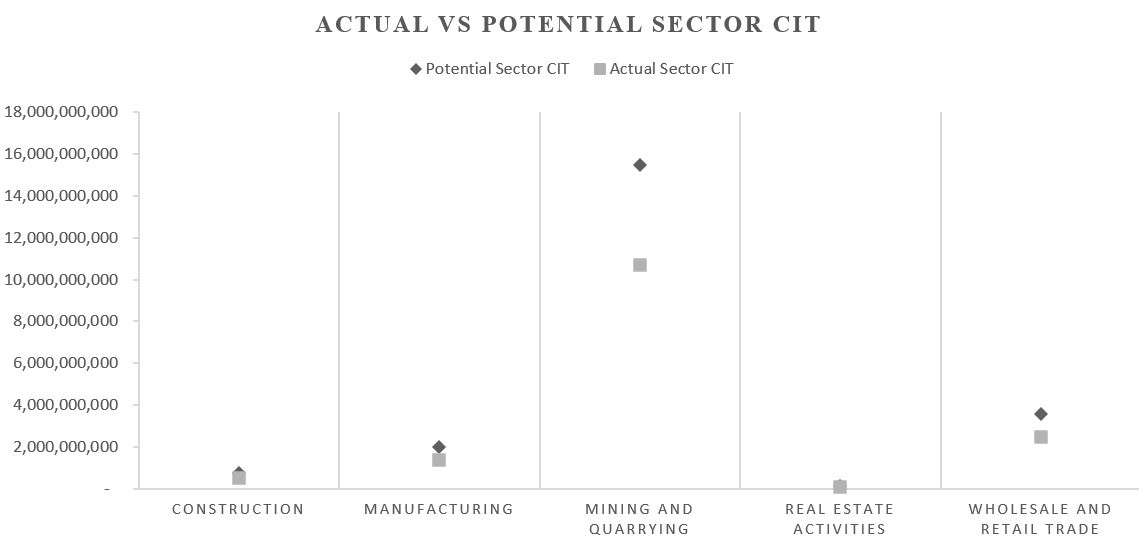

The extractives sector has the highest additional CIT revenue potential, while the highest additional VAT revenue potential can be found on the wholesale and retail sector

Countries can aim to increase tax revenue by either increasing tax rates or by enforcing compliance on the existing taxes. How much more revenue can be raised within the existing tax parameters depends on the share of potential tax revenue evading the tax net. This share is called the tax gap.

The challenge is knowing how large the tax gap is. By definition, a share of the tax is not paid, thus the value of the unpaid amount is also missing from the administrative records. If the lost revenue were easy to calculate it would also be easy to collect as tax revenue.

There are a few ways to estimate the tax gap. A macro approach uses national statistics to deduct the potential tax revenue and thereby the share of missing tax revenue. However, often these macro statistics are also based on tax record information, thus the tax gap estimate would be biased. In this study, an alternative micro approach was applied and audit information was used to deduce the prevalence of tax evasion in the country to subsequently calculate a national level estimate of the potential revenue.

Taking advantage of audit information to estimate the tax gap

Audit outcomes are one of the few sources of information on tax evasion, yet this information exists usually only for a small sample of firms as audits are costly to implement. This analysis takes advantage of information on audit outcomes based on this cohort of firms that were audited, together with their VAT and CIT return information from the Zambia Revenue Authority (ZRA). By relying on information on audit outcomes and information on various firm characteristics for the audited cohort, it is possible to estimate the evasion rates for non-audited firms. These evasion estimates for all firms are then aggregated to calculate the tax gap.

Audit outcomes are one of the few sources of information on tax evasion, yet this information exists usually only for a small sample of firms as audits are costly to implement. This analysis takes advantage of information on audit outcomes based on this cohort of firms that were audited, together with their VAT and CIT return information from the Zambia Revenue Authority (ZRA). By relying on information on audit outcomes and information on various firm characteristics for the audited cohort, it is possible to estimate the evasion rates for non-audited firms. These evasion estimates for all firms are then aggregated to calculate the tax gap.

For the prediction, two methods were applied: a regression method and a machine learning method. These methods are necessary because the audited firms represent a selected sample of all firms; hence their evasion rate may differ from an average firm. The regression approach yields an estimated 56% gap in the realized and potential revenue in Zambia on average from 2014–2020. The machine learning approach gives an estimated 47% for the same period. This relatively high tax gap is similar in magnitude for other developing countries.

Highest additional CIT revenue potential on the mining sector

The estimated tax gap suggests that there is clear revenue potential in enforcing tax compliance with the existing tax parameters in Zambia. Yet, this requires finding cost-effective enforcement policies so that the revenue impacts of the enforcement tools exceed the costs. Thus, it is likely not optimal to eradicate all evasion.

A sector-specific analysis suggests that the highest additional CIT revenue potential comes from the mining sector (see Figure 1), while the highest additional VAT revenue potential comes from the wholesale and retail sector. While this study predicts the evasion rates with tax record information, the estimates are likely to be lower bounds as the data does not include firms that are entirely outside the tax net.

Figure 1: Total actual vs. potential Corporate Income Tax (CIT) by key sector in kwacha

Note: Return values are based on study data and may deviate from official values

Zambia can achieve higher tax revenues without increasing tax rates by seeking cost effective ways to improve tax compliance

The analysis introduces useful new micro-based approaches to estimate tax gaps using audit information. These methods relying on regression and machine learning approaches can be useful in other countries too

A bottom-up micro approach avoids an over-reliance on external macro data — which can be hard to collect in developing countries

On top of providing new tax gap estimates for Zambia, the analysis outlines useful micro-based approaches to estimate tax gaps with audit information that can be useful in other countries too.

Join the network

Join the network