Policy Brief

How to support the emergence of effective tax systems

There has been a revival of interest in the state’s role in economic development. Recent research argues that the most successful economies are those where effective states provide crucial public goods and services. The historical emergence of effective tax systems and the related processes by which public finance institutions evolve are a fundamental part of becoming an effective state.

Cross-national or longitudinal evidence on which factors contribute to the development of effective tax systems in the Global South is lacking

Global South countries still collect less than half the tax revenue of higher-income countries, when measured as a share of GDP

A broad range of historical, political, and institutional factors determines the level of taxation, including limits on the executive branch, the information capacity of the state, and who traditionally assigns property rights

Tax capacity among sub-Saharan African countries is increasing, but is constrained by relatively low compliance among large and multinational firms and wealthy individuals

Unlike the case of Western Europe, where the role of wars and democratization—among other factors—is well established, it is less clear which factors contribute to the ability of states in the Global South to raise tax revenues.

The importance of taxation in developing economies

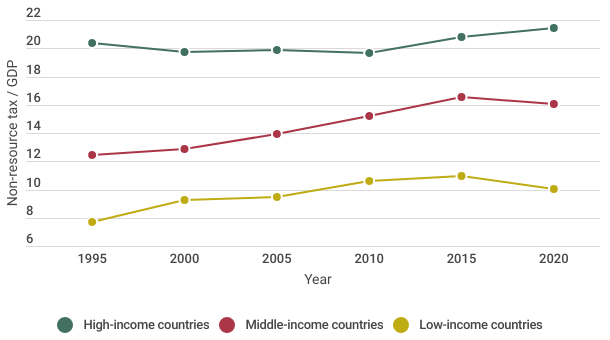

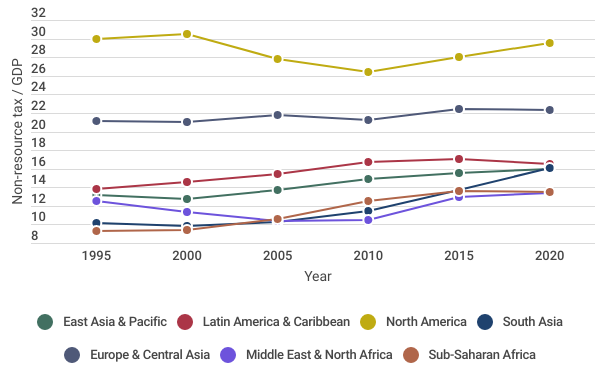

Higher-income countries collect, on average, more than double the share of total revenues compared to lower-income countries (Figure 1). By region, all others collect substantially lower taxes as a proportion of GDP than North America, Europe, and Central Asia (Figure 2). There is significant room to improve these figures among Global South countries.

Source: UNU-WIDER Government Revenue Dataset. Version 2022.

Source: UNU-WIDER Government Revenue Dataset. Version 2022.

There are three reasons why the emergence and consolidation of effective tax regimes matters for economic and social development.

First, tax revenues are needed to provide public goods and services. Typically, governments that collect more tax revenues also spend more on health and education.

Second, acquiring additional fiscal capacity through broad-based taxation has significant positive distributional impacts. Broadly levied income taxation, in particular, can act as a powerful redistributive tool and is a key feature of modern taxation. The proportion of taxes raised through income taxes as a share of GDP for low-income countries has significantly increased, but it is still about half of that for high income countries in the late 2010s.

Third, the development of taxation can be expected to bring about a ‘governance dividend’—the quality of government should improve because the taxpaying citizenry will subject state leadership to increased scrutiny.

How do fiscal states emerge?

Research on the historical origins of fiscal systems in sub-Saharan Africa finds links to several political, historical, cultural, and institutional factors. For example, Uganda’s higher tax-compliance norms can be explained by the state’s legacy of upholding authority and stronger social cohesion through interpersonal trust, but not by strong public institutions. This finding supports the argument that fiscal concepts and institutions from the Western European tradition do not easily translate to other contexts.

New empirical results show that tax performance in sub-Saharan Africa is high, in relative terms, and has improved for lower-income countries. The failure of governments in Africa to collect tax at the higher levels of their peers is linked to their relative inability to effectively tax multinational companies and wealthy individuals, rather than on the absence of structures needed to mobilize revenues.

Political determinants of taxation are important too. For example, the adoption and expansion of income taxes is found to be positively related to democratic norms and institutions that limit executive power. Another important finding is that there is no taxation without state-assigned property rights. In much of sub-Saharan Africa, property rights to land are governed by traditional authorities, which partly explains the challenges of building fiscal states on the continent. Related to this, research findings from Latin America indicate that the state’s ability to gather salient information on the territory they administer (information capacity) is complementary to the emergence of taxation.

Political determinants of taxation are important too. For example, the adoption and expansion of income taxes is found to be positively related to democratic norms and institutions that limit executive power. Another important finding is that there is no taxation without state-assigned property rights. In much of sub-Saharan Africa, property rights to land are governed by traditional authorities, which partly explains the challenges of building fiscal states on the continent. Related to this, research findings from Latin America indicate that the state’s ability to gather salient information on the territory they administer (information capacity) is complementary to the emergence of taxation.

What lessons can be drawn from the latest body of research on fiscal development?

First, Rome wasn’t built in a day. Learning to tax takes time and is inextricably linked to historical processes of statebuilding. At the same time, states in the Global South finance large shares of their activities through non-tax revenues (e.g., aid and development assistance, natural resource revenues, fees, etc.) and by borrowing from private and international financial institutions. Hence, policymakers should be mindful that financing state activities requires both effective taxation and other revenue sources.

Second, history matters. If and how fast a state can successfully develop tax systems depends on specific historical conditions, which cast a long shadow. For example, pre-colonial institutions can still affect tax compliance in sub-Saharan Africa.

Third, politics matters. Developing fiscal capacity is not only a technocratic exercise. While technical solutions to more efficient tax administration, for example new IT solutions to tax collection and administration, are important, it is just as critical to understand the politics which support the fiscal contract between the state and its citizens. Donors and policymakers can foster processes which engender greater trust in the system by allowing state institutions and citizens to hold governments accountable.

Policymakers should be mindful that financing state activities requires developing modern taxation while managing other sources of public finance

Complementarities are important: for example, developing legal institutions protecting property rights or states’ ability to collect information across their territory provides a base to improve tax revenues collection

Donors and policymakers need to foster processes which allow state institutions and citizens to hold governments accountable

Securing buy-in from local elites supports efforts to improve tax effectiveness

Fourth, fiscal capacity should not be looked at in isolation: it is crucial to invest in other dimensions of state capacity that support tax system development, such as information capacity and property rights protection. Developing fiscal capacity hinges on simultaneous institutional reforms in other areas. Complementarities are important.

Finally, elites matter. When a country’s politics is based on a dense network of social relations and is able to effectively provide the public goods necessary for broader economic development, political elites are able and more willing to engage in a project of systematic statebuilding.

Join the network

Join the network