Blog

Reflections on thinking development, thinking WIDER

What do we talk about at a conference on development economics? Well, robots, rockets, and space, of course.

13 September through 15 September 2018, UNU-WIDER hosted the Think development - Think WIDER conference in Helsinki, Finland. Over three days, participants from fifty-nine countries gathered at the Marina Congress Center to discuss the past, present, and future of development economics and the field’s role in addressing major global challenges.

Robots

Robots

One major theme at the conference was how our thinking on economic transformation changes because of the technological revolution. Labour-saving technologies, in the form of computers, robots, and artificial intelligence, are replacing jobs at a faster rate than previous tech revolutions. This has some major implications for development policy and thinking.

As a result of technological advancement, the global economy requires less and less human work. As Ravi Kanbur put it, the declining share of labour in global production is a reality that should fundamentally change the consensus view on what drives economic growth and development policy in practice.

The logical change is from supply-side interventions to demand-side interventions. I spell this out in more detail here, but for those of us not trained in econ-speak, this means that the role of the state in economic policy will need to focus a lot more on redistribution than it previously has. In other words, inequality is an even bigger deal because of, well, robots.

Martin Ravallion, who is famous for his work on poverty, opened his conference session with the surprising statement that it is time to worry less about poverty and more about inequality. Jonathan Ostry, from the International Monetary Fund (IMF), laid out the evidence for why redistribution is a pro-growth strategy, and David Furceri (IMF) discussed the need for more research on the ways in which monetary policy might redistribute wealth. This is just a small sample of the inequality discussion that took place in Helsinki.

This is a surprising departure from past convention. The economics profession of the past has mostly adhered to the primacy of growth, with distributional goals considered secondary. If the expert speakers at our conference are any measure, there seems to be a growing consensus that not only is there a role for public policy in this arena, but that redistributive policy could be one of the state’s primary roles going forward.

Read our coverage of the expert’s discussion here.

Rockets

Rockets

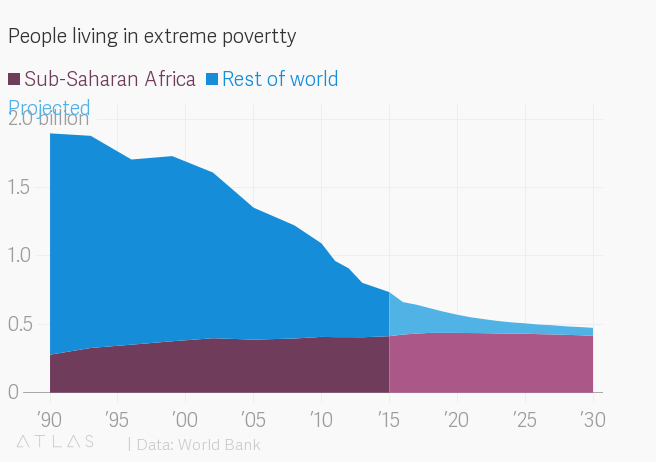

Nobody talked about real rockets at the UNU-WIDER conference, but they did talk a lot about the potential for launching something of a ‘take-off’ in Africa. Africa previously ‘missed the train’, in the words of Joseph Stiglitz’s new paper on the topic, when the train that was leaving the station was economic ‘take-off’.

Take-off is the stage of a country’s development that begins the structural transformation of its economy from a non-industrial economy to an industrial economy.

East Asian economies followed an export-oriented growth strategy through the 1980s and 1990s to achieve take-off. Latin America recovered its growth trajectory beginning in the 1990s and is largely succeeding in spite of a series of exchange rate, financial, and sovereign debt crises. But Africa, particularly sub-Saharan Africa, has not fared so well.

Sub-Saharan Africa has seen little growth and has actually de-industrialized since 1977. Instead of improvement, much of Africa has witnessed a deterioration in its share of manufacturing. This is partially a failure of the Washington Consensus, a development model put forward by the World Bank and the IMF in the late 1980s and 1990s, partly a failure of global institutions, partly the result of historical conditions, and partly a failure of African governments.

Although much has been written, by way of explanation, as to the causes of African malaise, very little of the conference talk dwelled here. Instead, the conversation focused on what to do about it, with a lively ongoing debate about whether Africa should, or even can, follow the successful East Asian model. And if not, what is the right model for the region?

Read more about this debate here.

Space

Space

The third major conversation was not about outer space, as you might have hoped, but policy space. This is the amount of room for maneuver policy makers have to address economic problems. Historically, the system of global governance has played a larger than expected role in policy space, by defining the types of options available to officials.

One of the most well-known examples may be what Joseph Stiglitz highlighted during his Saturday morning keynote, when he said:

'… the existing tariff structure is designed to keep developing countries producing low-value goods. [Developing countries] will have to take action to change this structure if they want to be able to develop'.

The comment was made in the context of the discussion about whether or not Africa’s way forward is the East Asian growth model.

Stiglitz was pointing to World Trade Organization (WTO) treaty obligations that limit policy space. These obligations are an important example precisely because the East Asian economies grew rapidly using some industrial policy tools now considered to be violations of WTO treaty agreements.

Stiglitz has a nice bumper-sticker version of successful policies subsequently banned. He calls it ‘pulling up the ladder’. Stiglitz clarified that he views the WTO as necessary, but that it needs some reforms.

As this demonstrates, global governance can restrict policy space, but it can also create policy space. This was not lost on anybody attending the Think WIDER conference. At the very broadest of levels, a radical conversation on the governance of the global monetary system took place, spurred by the co-director of Colombia’s central bank, the economist José Antonio Ocampo.

Whereas the trade system is mediated by layers of bilateral and multilateral trade agreements, with a history dating from 1944, and includes a major global adjudicating organization (the WTO), the monetary and financial system relies mostly on ad hoc commitments by heads of state and shared understandings between central bankers and finance ministers.

For this reason, Ocampo rightly calls it a (non)system in the title of his new book Resetting the International Monetary (non)System which is available free as a part of UNU-WIDER’s commitment to open access here.

With the crash of US banks beginning in 2007, the subsequent eurozone crisis, and the destabilizing shifts in capital flows to emerging market economies fresh in everyone’s minds, this conversation has a particular salience to it. Not least of all because there are new problems for Turkey and Argentina, the boom in capital flows to emerging markets during quantitative easing is in a full reversal, and we heard on Saturday the former Tanzanian central bank governor, Benno Ndulu, ringing the alarm on African sovereign debt.

The foremost complaint about global capital flows is that they are fickle, changing their direction and amplitude on impulse. This requires the monetary authority to build up foreign exchange reserves as insurance to buffer their economies from the inevitable fluctuations of capital flows. The requirement to respond to these fluctuations is seen as a limit on policy space. A more formal global system might help to reduce this limitation.

Among the items still unaddressed at the level of global governance are the following: 1) harmonization of exchange rate policies (or even an agreed upon definition of what exchange rate manipulation might be); 2) coordination on monetary policy and/or capital flow management; 3) the existence of any real global reserve currency; 4) agreements on international crisis-prevention methods; 5) sovereign-debt resolution mechanisms; and 6) the existence of a representative global organization like the WTO to act as forum and adjudicator.

The lack of a global monetary system is surprising because in 1944, when the first global trade agreement was signed, the effort to create a global monetary system was just as important as the effort to create a global trade system. The trade system succeeded, but the monetary system failed.

During the conference, Professor Ocampo shared with me how we got here.

To paraphrase, the reason these efforts were successful in trade, but not in finance, was not so much a lack of political will, but the result of the inexorable physics of global capital. The post-1944 era had something of a global monetary system, based on anchoring the US dollar to gold at a fixed price and maintaining a fixed exchange rate system. Then, a torrent of capital flows broke the system in 1971 and it was never put back together.

When I asked the economist why policy maker efforts to restore the system failed, he had a short answer: ‘the market beat them’.

'The market beat them’ is basically why policy makers struggle to restore order in the wake of economic crises. It is why not having a global monetary system is seen as restrictive to the policy space for promoting inclusive growth and development in the world’s lower-income countries.

To dive deeper into this conversation, you can download Ocampo’s book and sign up for the WIDERAngle newsletter to read the details of my two-hour interview (forthcoming) with the professor, central banker, and senior economist.

The views expressed in this piece are those of the author(s), and do not necessarily reflect the views of the Institute or the United Nations University, nor the programme/project donors.

Join the network

Join the network